Connecticut Homestead Exemption

Essential Facts and Benefits Explained

This article is part of our guide on the Homestead Exemption by State

The Connecticut homestead exemption is a valuable legal provision that offers a level of protection to homeowners from certain financial hardships, such as bankruptcy or foreclosure. This exemption grants eligible homeowners the ability to safeguard a portion of their home's equity, ensuring that they can maintain a stable place to live amid financial turbulence.

In essence, the homestead exemption works by excluding a specified amount of a home's value from being subject to creditor claims. As a result, this protection aids in preventing the forced sale of one's primary residence for the purpose of repaying debts. In Connecticut, homeowners must meet certain criteria and file the appropriate forms with the town clerk's office to qualify for this crucial safeguard.

It is crucial for Connecticut residents to understand the intricacies of the homestead exemption, as well as the process to claim it, in order to maximize their financial security. However, the amount and the scope of protection offered by this exemption may vary depending on various factors, such as the homeowner's age and the specific circumstances of their financial situation.

Understanding Homestead Exemption

Definition and Purpose

Homestead exemption is a legal provision that protects a certain amount of the value of a homeowner's primary residence from creditors. It exists to prevent individuals from losing their homes due to events such as bankruptcy, tax liens, or debts owed to unsecured creditors. This policy aims to maintain a level of economic stability and security for homeowners by safeguarding their most essential asset.

In Connecticut, the homestead exemption applies to a homeowner's primary residence which includes both real property (land and the structures attached to it) and certain mobile homes. It's worth noting that this exemption is offered only for one property.

Equity Protection

Equity protection is a significant aspect of homestead exemptions. Homeowners in Connecticut can protect up to $75,000 of the property's equity (a higher amount may apply for those who are disabled or elderly) from unsecured creditors. This means that if a creditor pursues a judgment against the homeowner, the homestead exemption will protect a portion of the home's value from being seized by the creditor.

Here's an example to illustrate how the homestead exemption protects a homeowner's equity:

Market value of the home: $300,000

Mortgage balance: $200,000

Home equity: $100,000

In this case, the homeowner has $100,000 of equity in their primary residence. However, Connecticut's homestead exemption only protects up to $75,000 of the homeowner's equity. Therefore, if a creditor has a judgment of $30,000 against the homeowner, they can potentially only force the sale of the home if the homeowner's non-exempt equity ($100,000 - $75,000 = $25,000) is sufficient to cover the debt and the costs associated with the sale.

Keep in mind that the homestead exemption doesn't apply to secured debts such as a mortgage or home equity loans. It is strictly designed to protect homeowners from unsecured creditors and potentially losing their homes due to financial difficulties.

Overall, understanding the homestead exemption and how it uniquely functions in Connecticut is essential for homeowners looking to protect their investment and maintain economic stability.

Connecticut Homestead Exemption Law

Current Exemption Amounts

In Connecticut, the homestead exemption is legally provided to homeowners, protecting a certain amount of their home's equity from creditors. As of 2023, the exemption amount in Connecticut is set at $75,000. This means that homeowners can protect up to $75,000 of their home's value from most types of creditors during bankruptcy or other financial judgments.

Eligibility Criteria

To qualify for the Connecticut homestead exemption, a homeowner must meet the following criteria:

The property must be the primary residence of the homeowner.

The homeowner must have a valid declaration of homestead, filed with the appropriate town clerk.

The homeowner must have equity in the property, meaning the property's value must exceed the outstanding mortgage balance.

It is important to note that the homestead exemption does not protect against all types of creditors. For example, it does not apply to mortgage lenders, tax liens, or child support and alimony cases.

Legal Framework

The legal framework for the Connecticut homestead exemption can be found in the Connecticut General Statutes, under Title 52 (Civil Actions), Chapter 922 (Exemptions). The relevant sections are:

§ 52-352b – Property exempt from the enforcement of a money judgment.

§ 52-352d – Request for disclosure.

These statutes outline the eligible exemption amounts, property types, and procedures for claiming the homestead exemption in the state.

Public Act Changes - HB 6466

In 2013, Connecticut passed the Public Act 13-156, also known as House Bill 6466 (HB 6466), which expanded the scope of the homestead exemption. This act made several changes:

The exemption amount was increased from $75,000 to a maximum of $125,000, depending on a homeowner's income and other factors.

The act clarified that the exemption amount applies to the net value of the property, i.e., after accounting for any liens against it.

The requirement for a separate, written declaration of homestead was simplified; merely residing in the property as the primary residence is now sufficient to establish a homestead.

HB 6466 helps provide additional protection for Connecticut homeowners by increasing the exemption amounts, simplifying the process, and clarifying the law.

Bankruptcy and Homestead Exemption

Chapter 7 Bankruptcy Implications

In Connecticut, the homestead exemption plays a crucial role in Chapter 7 bankruptcy cases. When an individual files for bankruptcy, they can protect a certain amount of their home's equity from being seized by creditors. Under Connecticut's homestead exemption law, a debtor can exempt up to $75,000 of their property value. This means if the debtor's equity is below or equal to this amount, the property will not be sold to repay the creditors.

If the debtor's spouse files for a joint bankruptcy, the exemption amount doubles to $150,000. It is essential for homeowners to assess their home's value and equity prior to filing for Chapter 7 bankruptcy to utilize this exemption effectively.

Claims and Liens Against Homestead

Even with a homestead exemption in place, certain claims and liens can still be enforced against the property. Tax liens imposed by the government supersede the exemption protection, as well as judgment creditor liens that were recorded before the debtor's bankruptcy filing.

Despite the exemption, a bank can still foreclose on the property if a debtor defaults on their mortgage or a lienholder can exercise their rights if the debtor fails to meet their financial obligations. The exemption cannot be applied to any secured debt, such as a mortgage or home equity loan.

Exemption in Bankruptcy Proceedings

In the bankruptcy proceedings, a trustee oversees the debtor's case and assesses the assets for possible liquidation. The homestead exemption serves as a shield to allow the debtor to protect a portion of their primary residence from being sold off by the trustee. This protection grants the debtor an opportunity to keep their home and start anew post-bankruptcy.

Here is a summary of key points in regard to Connecticut's homestead exemption in bankruptcy:

Exemption Amount: $75,000 per debtor, or $150,000 for a joint bankruptcy.

Application: Applies to the debtor's primary residence only.

Exceptions: Tax liens, pre-bankruptcy judgment creditor liens, and secured debts (e.g., mortgages, home equity loans).

Understanding Connecticut's homestead exemption laws and the implications for bankruptcy can be invaluable for those facing financial challenges. By being well-informed on the subject, individuals can make the best decisions for their situation and work to protect their assets as they navigate the bankruptcy process.

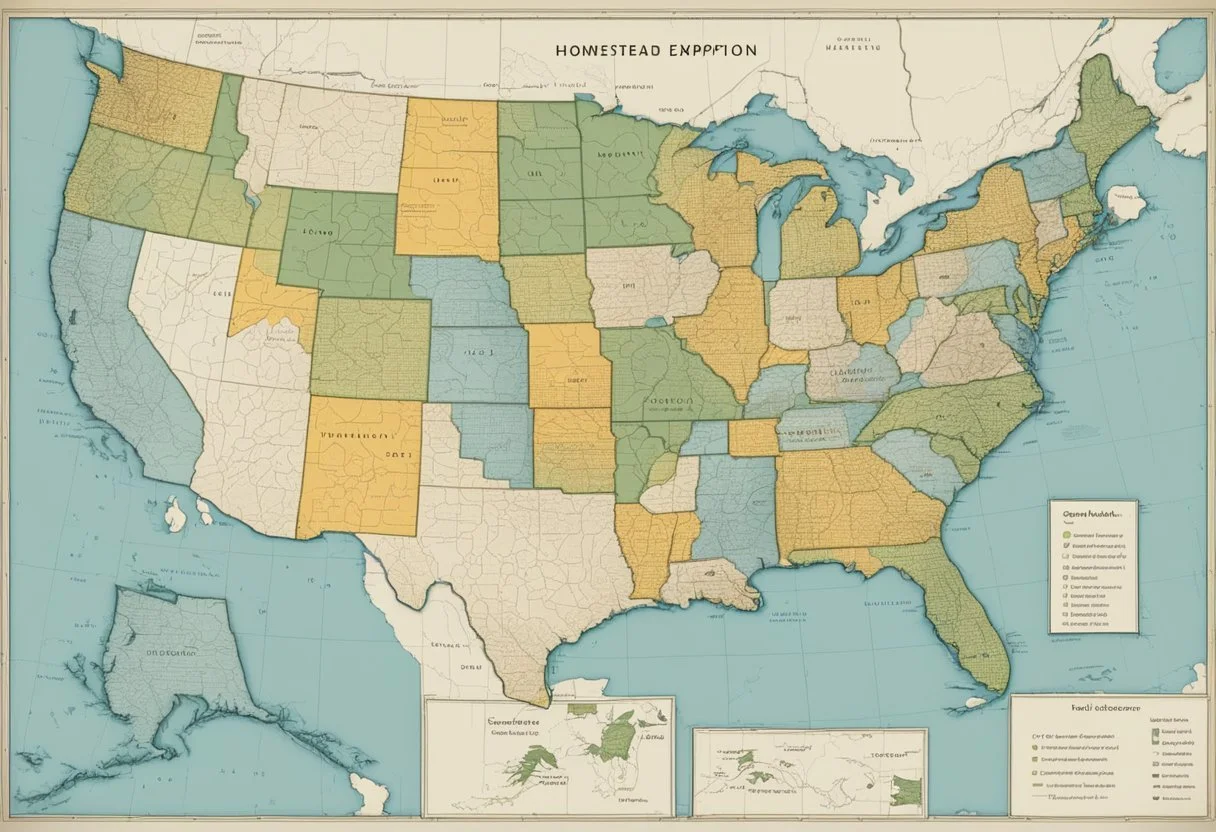

Comparing Exemptions Across States

State-by-State Comparison

Homestead exemptions vary from state to state, providing different levels of protection for homeowners. Here is a brief overview of some homestead exemptions in other states as compared to Connecticut:

Alabama: Homestead exemption of $15,000 for a single filer and $30,000 for a married couple.

California: The amount of the exemption depends on the homeowner’s age, income, and other factors, ranging from $75,000 to $175,000.

Connecticut: Homestead exemption amount is $75,000.

This is not an exhaustive list, but it serves to illustrate how exemptions can vary across states. The homestead exemptions can play a significant role in financial planning for homeowners and can provide some relief during challenging times such as bankruptcy.

Federal Versus State Exemptions

It's important to note the distinction between federal and state exemptions when considering the homestead exemption. Homeowners have the option to choose either the federal or state exemptions in some states for bankruptcy protection, while in other states, they must adhere to state exemptions.

For example, Connecticut is an "opt-out" state, meaning that homeowners must use the state exemptions rather than the federal exemptions. The federal homestead exemption is $25,150 for a single filer and $50,300 for a married couple.

In Texas, on the other hand, homeowners can choose between federal and state exemptions. The state exemption in Texas allows for an unlimited homestead exemption for property up to 10 acres in a city, town, or village, and 100 acres for a single person (200 acres for a family) in rural areas.

In summary, understanding the differences in homestead exemptions across states and the nuances between federal and state exemptions is crucial for homeowners to make informed decisions and protect their financial interests.

Additional Protections and Benefits

Property Tax Benefits for Homeowners

In Connecticut, several property tax relief programs are available for homeowners, providing financial assistance and additional protection. These programs target specific groups, such as elderly homeowners, disabled homeowners, and veterans. Key benefits include:

Circuit Breaker Program: A tax credit program for qualifying elderly and disabled homeowners, providing a credit based on their property tax payment.

Tax freezes: Property tax freezes are available for eligible elderly homeowners, ensuring that their property taxes will not increase as long as they meet the eligibility criteria.

Tax deferral programs: These programs allow qualified elderly and disabled homeowners to defer their property tax payments until they sell their home or pass away.

Special Circumstances Relief

Connecticut offers additional relief for certain groups, including firefighters, emergency personnel, and surviving spouses of those who have served in specific functions. Some of the particular relief measures are:

Disabled veterans: Connecticut provides property tax exemptions for disabled veterans, with the exemption amount based on the percentage of disability.

Firefighters and emergency personnel: Volunteer firefighters and emergency medical personnel may qualify for property tax abatements in certain towns, as a form of recognition and compensation for their essential services.

Surviving spouses: In some cases, surviving spouses of deceased public safety personnel or military service members may be eligible for property tax relief, helping to ease the financial burden after the loss of their loved one.

Overall, Connecticut's homestead exemption and various property tax relief programs work together to provide diverse protections and benefits for homeowners in the state. These measures strive to ease the financial burden on vulnerable or deserving groups by providing tax credits, freezes, deferrals, and exemptions.

Procedures and Required Documentation

Filing for Homestead Exemption

In Connecticut, homeowners can apply for a homestead exemption to protect their property's value from certain creditors. The homestead exemption allows homeowners to safeguard a portion of their home's fair market value, depending on their situation. To file for a homestead exemption, applicants must follow these steps:

Obtain the necessary forms from the local government office responsible for property assessment. These forms may also be available online for download.

Fill out the application form completely, providing personal information, property details, and financial data where requested.

Sign and date the form in the presence of a notary public.

Submit the completed application along with the necessary documents to the local government office.

Note: Filing deadlines may vary based on the applicant's specific circumstances. It's crucial to check with the local government office for specific information on when to submit the application.

Documents Necessary for Filing

The following documents may be required when filing a homestead exemption application in Connecticut:

Proof of Ownership: A copy of the deed, mortgage, or other document that demonstrates legal ownership of the property.

Proof of Residence: Documents such as a utility bill, voter registration, or driver's license, indicating that the property is the applicant's primary residence.

Proof of Income: For applicants with limited income, proof of income may be necessary to qualify for the exemption. This can include tax returns, pay stubs, or Social Security benefit statements.

Marriage Certificate (if applicable): Married couples who are jointly applying for the exemption may need to provide a copy of their marriage certificate.

By following the above procedures and providing the required documentation, Connecticut homeowners can apply for a homestead exemption to protect their interest in their property's market value. However, it's essential to keep in mind that the specifics of the process may vary depending on the local government office, so it is always advisable to consult with local officials for the most accurate information.

Future Developments and Legislative Changes

Potential Amendments

In Connecticut, homestead exemption laws continue to be the subject of discussions and potential amendments. With the goal of protecting homeowners from the potential threats of creditors or bankruptcy, it is possible that future adjustments to the exemption amount or qualifications may be proposed by state lawmakers. Governor Ned Lamont and the state legislature might introduce new bills or amendments to provide enhanced protection to homeowners in case of financial distress.

Recent Legislative Actions

In recent years, there have been a few legislative actions in Connecticut concerning the homestead exemption. For example:

Bill A: In 2019, a bill was proposed to increase the homestead exemption amount to $75,000. This aimed to provide more protection to homeowners. Although it did not pass, it demonstrated the continuous efforts to adjust the homestead exemption rules.

Bill B: Another bill sought to modify the eligibility criteria for homestead exemptions, particularly for elderly homeowners. The proposal was to offer a higher limit with specific qualifying factors such as age and income levels. However, the bill has not been enacted into law as of now.

As Connecticut continues to adapt its homestead exemption laws, it is important for homeowners to stay informed about any changes that may affect their property protection rights. By following the actions of Governor Ned Lamont and the state legislature, residents can remain aware of any developments that may impact their homestead exemption status in the future.