Carson County TX Ag Exemption

Eligibility and Benefits Explained

This Article is Part of Our Guide on the Ag Exemption in Texas

Agricultural exemptions in Carson County, Texas, serve as significant benefits for landowners engaged in farming, ranching, or timber production. These exemptions can substantially reduce the property tax burden on landowners by categorizing certain property and purchases as essential for agricultural production. They are a crucial part of the Texas Property Tax Code and are managed by local appraisal districts.

In Carson County, the appraisal district is responsible for the administration of ag exemptions. Landowners seeking to obtain an ag exemption must provide appropriate documentation, which may include a copy of the state-issued identification and, in some cases, a completed affidavit. These documents substantiate the applicant’s eligibility for the exemption under the Texas Property Tax Code.

The Carson County Appraisal District further assists taxpayers by publicizing the capitalization rate used to value properties receiving exemptions. This rate is determined annually and influences how properties under ag exemption are appraised for tax purposes. Understanding these rates and the requirements for ag exemptions can help eligible property owners in Caron County navigate the process and secure the financial benefits for which they qualify.

Understanding Ag Exemptions in Texas

Texas provides agricultural exemptions to support its farming and ranching industries. These exemptions have specific parameters and vary when compared to other states.

Definition and Purpose of Agricultural Exemptions

Agricultural exemptions in Texas are designed to reduce the tax burden on farmers and ranchers, ensuring that they can invest more in the cultivation and production of agricultural goods. The primary purpose is to promote agricultural sustainability by allowing property used for qualifying agricultural activities to be appraised based on its agricultural value rather than its market value. This can significantly lower property taxes for those in the agricultural sector.

Key point: The exemption applies to certain items used exclusively in the production of agricultural and timber products for sale.

Comparison to Other States

When considering agricultural exemptions, Texas stands out for its dedicated support of the agriculture industry. Each state has its own guidelines for ag exemptions, but Texas's approach is particularly beneficial to those engaged in agriculture and timber production. Some states may offer reduced rates or different forms of exemptions, but Texas provides a clear path for obtaining and renewing agricultural and timber exemption registrations.

Key point: Texas requires eligible producers to renew their Agricultural and Timber Exemption tax numbers every four years, which is a unique feature compared to some other states that may have different renewal policies or no renewal requirements at all.

Note: The agricultural exemption in Texas is specifically tailored to benefit those engaged in the appropriate agricultural activities and is fairly unique in its setup and administration compared to other states’ programs.

Eligibility and Qualification Criteria

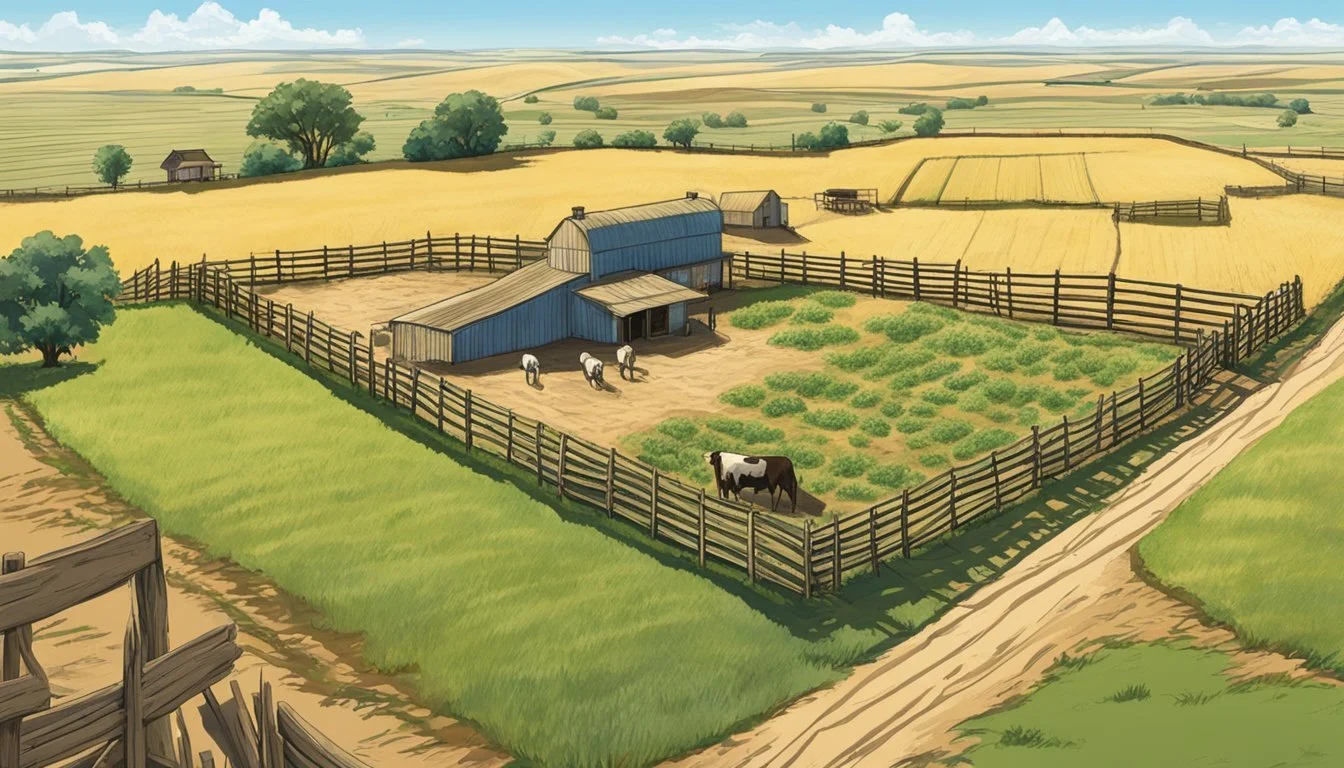

The eligibility for an agricultural exemption in Carson County, Texas, hinges on specific land use practices and the presence of qualifying agricultural activities. Owners must ensure their land actively contributes to agricultural production whether through traditional farming, raising livestock, or engaging in wildlife management.

Land Use and Agricultural Activities

The land must be principally utilized for agricultural purposes which includes the production of crops, livestock, poultry, fish, or cover crops. The core requirement is that the land should not be dormant but actively engaged in contributing to agriculture or timber production. For Carson County residents, this translates to a consistent use of the land within these parameters.

Livestock and Crop Requirements

Qualifying as a landowner for the exemption necessitates adherence to Carson County's specific livestock and crop guidelines. Livestock production can qualify if there is breeding, raising, and grazing of animals on the land. Similarly, for crops, there must be active cultivation, planting, and harvesting of agricultural products. Documentation of these activities may be required to maintain the exemption status.

Wildlife Management as Qualifying Use

Wildlife management can also serve as a qualifying agricultural activity under certain conditions. In Carson County, engaging in wildlife management entails actively using the land to propagate a sustaining breeding, migrating, or wintering population of indigenous wild animals. The intent must be clear that the primary use is for wildlife management within the context of agricultural pursuits.

Tax Implications and Benefits

In Carson County, TX, agricultural (ag) exemptions play a critical role in defining the tax landscape for landowners. These exemptions can significantly affect both the property taxes they pay and the market value of their land.

Property Tax Reduction and Market Value

Ag exemptions in Carson County can lead to a substantial reduction in property taxes. For a landowner to benefit, the property must be primarily used for legitimate agricultural purposes. Upon granting the exemption, the market value of the property, which is usually based on the price it would sell for in an open market, is replaced with an agricultural valuation that is often much lower. This lower valuation directly translates to a lower property tax liability.

Without ag exemption: Property tax is calculated on the market value of the land.

With ag exemption: Property tax is based on the specially assessed value which is influenced by the agricultural use of the land.

Special Valuation and Rollback Tax

Special valuation methods for agricultural properties take into account the land's capacity to produce agricultural goods rather than its market value. This valuation method recognizes the importance of agricultural production in Carson County and aligns the tax burden with the agricultural use rather than the potential market price of the land.

However, if a change in land use occurs, a rollback tax is applied. The rollback tax is the difference between the taxes paid on the land's agricultural valuation and what would have been paid based on the land's market value for each of the previous five years. It intends to recover some of the tax revenues lost due to the agricultural valuation if the land is no longer used for that purpose.

Rollback tax triggers: Changing the land use from agricultural to non-agricultural.

Application Process

To acquire an agricultural exemption in Carson County, Texas, applicants are required to navigate a series of steps to ensure proper documentation and submission to the Carson County Appraisal District.

Required Documentation and Registration

Before proceeding, applicants must gather necessary documentation which includes proof of agricultural activities and land usage. The cornerstone of documentation is obtaining the Texas Agricultural and Timber Exemption Registration Number (Ag/Timber Number). This can be done by completing the AP-228 Application for Texas Agricultural and Timber Exemption. It is crucial to secure this number as it plays a significant role in the exemption certification process.

To further certify eligibility for the agricultural exemption, the applicant must also fill out the 01-924, Texas Agricultural Sales and Use Tax Exemption Certification, or for timber operations, the 01-925, Texas Timber Operations Sales and Use Tax Exemption Certification.

Appraisal District Submission Procedures

Once all documentation is in place, applicants must submit their application to the Carson County Appraisal District. The district has specific procedures and requirements, including the submission of a driver's license or identification as stipulated by the Texas Property Tax Code.

In certain situations, applicants must complete an affidavit to demonstrate their qualification for the exemption. It is imperative to adhere to the submission protocols and deadlines established by the appraisal district to ensure a timely and smooth application process.

Additional Exemption Types

In Carson County, Texas, agricultural exemptions extend beyond crops and livestock production. They encompass industries such as forestry and aquaculture, as well as services related to veterinary care and the operation of kennels.

Timber and Fish Farm Exemptions

The timber exemption in Carson County applies to land used primarily for the production of timber or timber products. Eligible property owners can see a reduction in property tax liability proportionate to the productivity value of their timberland rather than market value.

Eligibility Requirements:

Land must be actively engaged in timber production.

The owner must follow sustainable forestry practices.

Commercial fish farm operations qualify for exemptions similar to traditional agriculture. Operations must be directed at raising fish for sale as a primary business activity to be eligible.

Conditions for Exemption:

The operation is used for breeding, raising, or harvesting fish.

The primary purpose is selling the fish in commercial markets.

Veterinary and Kennel Operations

Carson County acknowledges the role of veterinary businesses in the agricultural landscape by offering certain tax exemptions. These exemptions can apply to equipment and supplies used directly in the care and treatment of farm animals.

Examples include:

Medical instruments

Pharmaceuticals used for animals

Kennels that are engaged in breeding or boarding of livestock or performance animals may also qualify for exemptions. These facilities must operate where care and maintenance are provided as part of their service.

Qualifications for Kennels:

They must offer services such as breeding, boarding, or training.

The primary clientele should consist of working or production animals.

Educational and Conservation Programs

Carson County, Texas, supports its agricultural community through a variety of educational and conservation programs. These initiatives are designed to foster the next generation of agricultural professionals and ensure sustainable farming practices.

Future Farmers of America and 4-H

Carson County engages youth in agriculture through two principal organizations: Future Farmers of America (FFA) and 4-H. These groups play a crucial role in shaping young minds to understand agricultural principles and conservation.

FFA: Focuses on leadership, personal growth, and career success through agricultural education.

4-H: Offers a diverse curriculum that ranges from animal husbandry to crop science, emphasizing hands-on learning and community service.

Training Programs and Vocational Courses

Agricultural education in Carson County is complemented by a suite of training programs and vocational courses. These programs are instrumental in providing practical, skill-based education.

Vocational Courses: Cover a broad spectrum of agricultural topics, preparing students for careers in various farming sectors.

Training Programs: Offer specialized knowledge in conservation techniques and sustainable farming practices, vital for maintaining the county's agricultural integrity.

By investing in these educational and conservation programs, Carson County not only equips its residents with the tools needed for modern agriculture but also ensures the stewardship of its natural resources for future generations.

Ongoing Compliance and Responsibilities

In Carson County, Texas, agricultural exemptions provide significant tax relief, but they come with stringent compliance requirements. Landowners must ensure continuous eligibility and adapt to land use changes to maintain their tax benefits.

Maintaining Eligibility

To maintain eligibility for an agricultural exemption, Carson County landowners must continuously use their property for agricultural purposes. This involves meeting a specific Degree of Intensity standard, which is based on regional agricultural practices and may include the number of cattle per acre or production output for crops. It is the landowner's responsibility to document such use and to provide evidence if requested by the county appraisal district.

Documentation may include:

Sales receipts

Production records

Leasing agreements

Compliance checks are regularly conducted, and failure to maintain these standards could result in the loss of exemption status.

Dealing with Changes in Land Use

Landowners must report any changes in land use to the Carson County Appraisal District. Transition from agricultural to non-agricultural use can result in the loss of the exemption and may lead to rollback taxes. Rollback taxes are calculated as the difference between the taxes paid on the valuation with the exemption and the taxes that would have been paid if the land had been assessed on its higher market value, usually covering the previous five years plus interest.

When reporting a change, landowners should provide:

A detailed description of the new use

The specific date of the change

For land transitioning to another agricultural use or lying fallow as part of a typical rotational scheme, there may be no impact on the exemption status. However, starting a non-agricultural enterprise, such as commercial development, will affect eligibility.

It falls upon the landowner to ensure proper use and to alert the appraisal district of any changes that might affect their agricultural exemption status.

Resources and Assistance

Carson County agricultural exemptions provide a means to lower property tax liabilities for qualifying landowners. Assistance and information for these exemptions are accessible through various state resources, particularly via the Texas Comptroller's office.

Texas Comptroller and Property Tax Assistance

The Texas Comptroller of Public Accounts plays a pivotal role in assisting landowners with agricultural exemptions. They offer detailed guides about the Ag/Timber Number registration and renewal process, critical for those seeking to claim exemptions on agriculture and timber purchases. Importantly, all Ag/Timber numbers expire at the end of a set period, necessitating timely renewal.

To support taxpayers, the Comptroller's Office sends out renewal notifications well in advance. They ensure that necessary information and forms are mailed out, which, in this instance, occurred in August 2023 for the most recent renewal cycle. Besides, they maintain a robust Property Tax Assistance Division to answer any queries and provide direct support to landowners, addressing both the initial registration and the ongoing maintenance of exemptions.

Frequently Asked Questions

Landowners often have numerous questions regarding Ag exemptions and the Carson County Appraisal District anticipates this by providing clear and concise answers. Areas typically covered in their FAQs include:

Eligibility criteria: What qualifies a property for the agricultural exemption?

Application process: How can one apply for an Ag exemption, and what documents are needed?

Maintaining exemptions: What are the standards and practices to continue benefiting from the exemption?

These resources are aimed at demystifying the process and helping landowners make informed decisions about their property tax responsibilities. The Carson County Appraisal District is also available to offer personalized assistance and can aid in clarifying any uncertainties about the local committee's role and typical agricultural standards within the county.

Local Impact and Statistics

This section examines the concrete effects that agricultural exemptions have on the financial framework of Carson County, with a focus on the local economy and urban agricultural activities.

Economic Influence in Carson County

Agricultural exemptions significantly bolster Carson County's economy. They allow for reduced tax liabilities, which in turn encourage investment in farm and ranch operations. Tax savings attained through these exemptions are often reinvested into local businesses, agricultural technology, and workforce development. This reinvestment can positively affect the county's overall economic health. The Panhandle region, with Carson County at its heart, sees agribusiness as central to its financial identity.

Investments: Local farmers and producers inject capital into the community.

Employment: Farming and ranching offer jobs, sustaining the county's employment levels.

Technology and Innovation: Savings on taxes enable the purchase of advanced equipment, promoting efficiency.

Agricultural Presence within City Limits

Within Carson County's city limits, urban farming benefits from the agricultural exemption policy.

Intersecting Presence: Farming operations within city limits provide fresh, local produce to urban centers, advocating for a sustainable city model.

Enhanced Land Use: Agricultural exemptions encourage the optimal use of land, preserving the agricultural legacy of the region while supporting greener practices in urban areas.

Carson County's exemptions create a favorable environment for the county's agricultural sector to thrive, driving economic growth and promoting sustainable urban farming practices.