Gonzales County TX Ag Exemption

Navigating Criteria and Benefits

This Article is Part of Our Guide on the Ag Exemption in Texas

Gonzales County, Texas, recognizes the vital role of agriculture in its community and economy, offering an agricultural (ag) exemption to qualifying property owners. This exemption isn't an outright reduction in taxes but rather a special method of valuation for property tax purposes. The Texas Comptroller of Public Accounts oversees the application of these exemptions, which are based on the land's agricultural use rather than its market value, potentially reducing the tax burden for landowners engaged in agricultural production.

To maintain this agricultural valuation and continue benefiting from the exemption, property owners in Gonzales County must adhere to specific guidelines and requirements set forth by the state of Texas. For instance, ag/timber numbers, a form of identification for those engaged in agriculture and timber production, must be kept current and underwent a renewal process by December 31, 2023, according to the Texas Comptroller's directive.

Gonzales Central Appraisal District plays a key role in administering exemptions and special valuations, including the agricultural exemption. Property owners seeking to apply or renew their ag exemption must do so through the appraisal district, utilizing the requisite forms and understanding the valuation process. It's essential to ensure accurate and timely submissions for exemption applications to avoid any interruption in receiving the agricultural valuation benefits.

Eligibility for AG Exemption

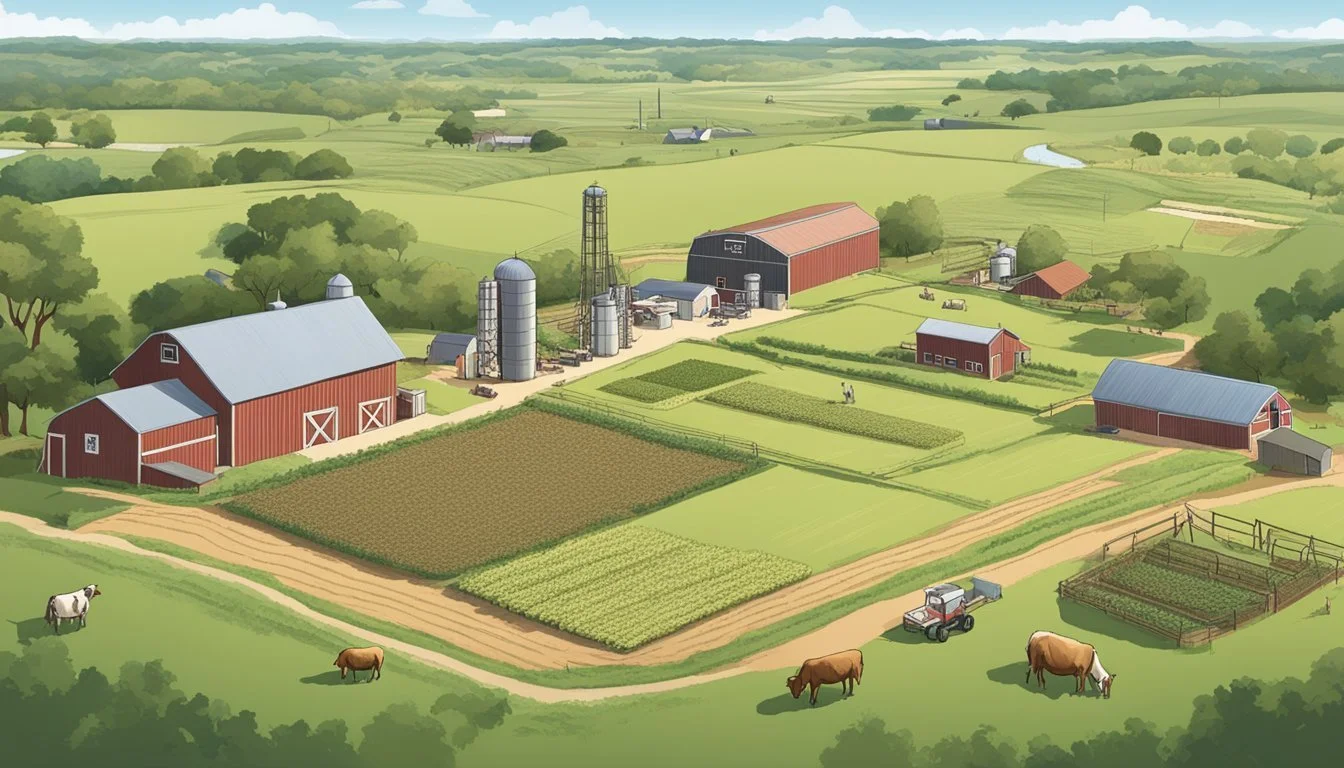

In Gonzales County, Texas, landowners may apply for an agricultural exemption to lower the property taxes on their land by having it appraised based on its ability to produce agricultural products instead of its market value. Eligibility criteria include the land's agricultural use, meeting minimum acreage requirements, and adhering to intensity standards dictated by the county.

Understanding Agricultural Use

Agricultural use encompasses various activities such as livestock raising, beekeeping, timber production, and crop cultivation. For land to qualify for an ag exemption in Gonzales County, it must be principally used for agriculture, which is the cultivation of the soil, producing crops, raising livestock, poultry, fish, or cover crops. It may also include managing wildlife or fish farms.

Livestock includes cattle, sheep, goats, pigs, horses, and other animals raised for food, fiber, or labor.

Crops can consist of grains, vegetables, fruits, and forage.

Beekeeping must involve the maintenance of bee colonies in hives for honey production, pollination services, or the breeding of bees.

Timber production refers to the cultivation of forests for the harvesting of wood.

Minimum Acreage Requirements

The size of the land plays a critical role in determining eligibility for an agricultural exemption. Gonzales County appraisers set specific minimum acreage requirements that must be met. These requirements ensure that the land is utilized effectively for agricultural purposes.

The typical minimum acreage for general agriculture can range depending on the type of activity; however, precise acreage stipulations for Gonzales County should be confirmed with the local appraisal district.

Beekeeping, due to its lower space requirement, usually requires fewer acres than, for example, livestock or crop production.

Intensity Standards

A proper understanding of intensity standards is vital for landowners seeking an ag exemption. The land must be used to a degree of intensity generally accepted in the area for similar agriculture operations.

Livestock operations, for instance, should reflect proper stocking rates per acre as per local industry standards.

Cropland should be cultivated at a frequency and with practices consistent with appropriate agricultural production.

Beekeeping and timber production activities must also match the intensity of management and production appropriate for these types of operations in Gonzales County.

Landowners should consult with the Gonzales County Appraisal District for specific guidelines related to intensity standards for each type of agricultural production. Compliance with these standards is assessed regularly to ensure the continued eligibility for the agricultural exemption.

Application Process

The application process for obtaining an agricultural exemption in Gonzales County, TX, is systematic, aimed at validating eligibility and ensuring compliance with Texas Property Tax Code. Landowners need to gather the necessary forms, submit them correctly, and be aware of renewal procedures to maintain their exemption status.

Acquiring Application Forms

Application forms for the agricultural exemption can be obtained online or via mail. The Gonzales Central Appraisal District provides necessary forms such as the Application for Texas Agricultural and Timber Exemption Registration Number (Ag/Timber Number). These forms are available for download in PDF format from the appraisal district’s official website or the Texas Comptroller of Public Accounts site.

Online: Download forms from the Comptroller’s website or the appraisal district's website.

Mail: Request forms to be mailed by contacting the Gonzales Central Appraisal District.

Submitting Applications

Once the forms are completed, applicants must attach the required documentation, such as a copy of their driver's license or other information as mandated. Submission can be done through:

Mail: Send completed forms to the Gonzales Central Appraisal District's P.O. Box.

In-Person: Deliver the forms to the appraisal district's office during established working hours.

Submitting through mail: Gonzales Central Appraisal District P.O. Box 867 Gonzales, TX 78629-0867

All applications must include:

Completed application form

Copy of driver’s license or other required information

Renewal Procedures

Renewal of an Ag/Timber number is essential to continue claiming the exemption. The renewal process must take place before the expiration date. The Texas Comptroller of Public Accounts handles the renewal process and sends out renewal notices.

Expiration: All Ag/Timber numbers expire on Dec. 31, 2023.

Renewal Notices: Mailed by the Comptroller’s Office during August 2023 to the address on file.

Renewal Submission: Completed through mail or online before the deadline.

Renewal steps include:

Receiving the renewal letter from the Comptroller’s Office.

Completing the necessary forms and requirements outlined in the letter.

Submitting before the expiration of the existing Ag/Timber number.

Tax Benefits and Calculations

In Gonzales County, Texas, agricultural exemptions offer significant tax benefits for eligible landowners. These benefits are chiefly realized through alternate methods of property valuation, which can reduce property taxes.

Market Value vs. Productivity Valuation

To understand the tax benefits of an agricultural exemption, one must contrast market value with productivity valuation. Market value assesses property based on its highest and best use in the current market, which can be high for developable land. Conversely, productivity valuation calculates taxes based on the land’s ability to produce agricultural or timber products. This generally results in a lower tax liability, as the focus shifts from potential market value to actual agricultural use.

Example:

Market Value: $10,000 per acre

Productivity Valuation: $1,000 per acre

Calculating Potential Tax Savings

Tax savings are calculated by comparing what taxes would be owed on the land's market value against what is owed under productivity valuation. Gonzales County landowners can use the following formula to estimate their tax savings from the agricultural exemption:

Determine market value of the property.

Assess the property’s productivity valuation.

Apply the appropriate tax rate.

Subtract the tax owed under productivity valuation from the tax owed under market value.

Calculation:

Tax Owed (Market Value) = Market Value x Tax Rate

Tax Owed (Productivity Valuation) = Productivity Valuation x Tax Rate

Potential Tax Savings = Tax Owed (Market Value) - Tax Owed (Productivity Valuation)

By using productivity valuation, landowners can diminish their overall property tax burden, assuming their land is primarily used for agricultural purposes and generates agricultural products for sale, as required by Texas law for the exemption to apply.

Compliance and Documentation

When applying for an agricultural exemption in Gonzales County, TX, it is essential for landowners to maintain accurate and detailed records. Proper documentation supports proof of eligibility and ensures compliance with the regulations set by the Gonzales Central Appraisal District.

Maintaining Proper Records

Landowners must keep comprehensive records that illustrate active use of their land for agricultural purposes. These records should include:

Invoices and Receipts: Documentation of expenses including feed, fertilizer, and equipment related to the agricultural operation.

Sales Receipts: Proof of income from the sale of agricultural products or livestock.

Activity Logs: Detailed descriptions of daily operations, such as planting, harvesting, and livestock management.

Providing Proof of Eligibility

To qualify for the agricultural exemption, applicants are required to demonstrate that their operations meet the state and county criteria. They must provide:

Affidavit: A formal sworn statement of facts that serves as evidence for the exemption.

Application for Texas Title (if applicable): Documentation required for titling agricultural equipment or vehicles in the state.

Exemption Certificate: The official document confirming the landowner's eligibility for tax exemption.

Applicants must submit this documentation upon request to support their application and validate their claim for an agricultural exemption. Failure to provide required proof may result in the loss of exemption status.

Types of Agricultural Activities Qualifying for Exemption

In Gonzales County, Texas, agricultural exemptions are granted for a variety of agricultural operations that engage primarily in the production of goods for sale. These exemptions provide significant tax relief and are tailored to the nature of each agricultural activity.

Livestock Raising and Management

Exemptions for livestock raising and management include operations that focus on breeding, feeding, and caring for animals. In Gonzales County, this can apply to traditional ranching activities, involving cattle and sheep, as well as exotic livestock such as ostrich (What wine goes well with ostrich?) or alpaca. Feedlot operations, where livestock are fattened before slaughter, also qualify for tax exemptions.

Crop Farming and Production

Crop farming and production is another major category for exemptions. Farmers engaged in cultivating soil and producing crops obtain exemptions for a range of cash crops like cotton and emerging crops such as hemp. These activities encompass planting seeds, harvesting, and crop dusting. Additionally, commercial nursery operations that grow plants for sale, including ornamental flowers and shrubs, qualify under this category.

Other Qualifying Agricultural Activities

Gonzales County recognizes several other activities associated with agriculture that are eligible for tax exemption. These include wildlife management practices that contribute to the preservation of habitats and population control for hunting purposes. Commercial fish farm operations engaged in breeding and rearing fish for food production also fall under this exemption. Moreover, custom harvesting services and crop dusting businesses, which provide specialized support to farmers, are included.

Frequently Asked Questions

This section covers essential topics regarding Gonzales County, Texas's agricultural exemption, including requirements for land and livestock, the implications of land use for tax status, and the potential financial impacts that come with changing a property's use.

Acreage and Animal Units Requirements

To qualify for an agricultural exemption in Gonzales County, TX, a property owner must meet certain acreage and animal unit standards that demonstrate the property is used for genuine agricultural purposes. The minimum acreage required can vary depending on the type of agricultural activity. For livestock raising, it often depends upon the standard amount of land necessary to support a single animal unit.

Animal Units per Acre:

Cattle: Typically 1 unit per 1-2 acres

Goats/Sheep: Usually more units per acre due to lower land impact

The agricultural business must also adhere to intensity standards which stipulate the active and regular use of the land in a manner that’s typical for the area.

Property Usage and Tax Exemption Status

Gonzales County properties using land for qualifying agricultural activities may be eligible for tax exemptions. To maintain an exemption status, the property must be used primarily for agriculture, such as:

Cultivating soil

Producing crops

Raising livestock

Usage must be consistent with the definition of agricultural use under Texas law. Activities unrelated to agriculture or inconsistent intensity of use may jeopardize exemption status.

Rollback Taxes and Their Implications

If a property in Gonzales County undergoing a change in use from agricultural to non-agricultural, rollback taxes may apply. Rollback taxes are additional taxes that can be levied on the property to recoup tax benefits received during exemption.

Rollback calculation: Based on the difference between taxes paid on the land's agricultural value and what would have been paid if it had been taxed at its higher market value.

Timeframe: Typically covers the current year plus five previous years.

Understanding this financial risk is essential for property owners considering altering the land's use.

Resources and Further Reading

Those seeking comprehensive information on agriculture exemptions in Gonzales County, Texas, will find valuable resources within the Texas Comptroller's office and the Gonzales Central Appraisal District. These resources offer clarity on eligibility criteria, application processes, and the legislative framework governing agricultural exemptions.

Texas Comptroller Resources

The Texas Comptroller of Public Accounts plays a pivotal role in overseeing agricultural and timber exemptions. Their resources entail a breadth of information, starting with eligibility requirements, qualified and non-qualified activities, to guidance on how to maintain the exemption status. For detailed insights on exemptions and related tax benefits:

Visit the comptroller's website or specifically the eSystems/Webfile portal to file applications or access forms.

Reference material such as the Texas Property Tax Code offer legal context and can be found through comptroller's resources.

Understand how the Texas Constitution underpins tax legislation that affects agricultural valuations.

The Texas Comptroller's website is a robust starting point for anyone requiring official state guidance on agricultural exemptions.

County Appraisal District Information

The Gonzales Central Appraisal District is the local entity responsible for the appraisal of property within Gonzales County for tax purposes. It provides:

Model forms and exemption applications that landowners can mail directly for processing.

Current year tax rate information as required by Section 26.16 of the Texas Property Tax Code.

For personal assistance and to submit any necessary documentation, property owners should contact the Gonzales Central Appraisal District directly. Their office details specific to agricultural valuations and exemptions offer localized support essential for taxpayers in Gonzales County.

Additional Considerations for Gonzales County Residents

Before applying for an agricultural exemption in Gonzales County, Texas, residents should be familiar with the local agricultural landscape and how it informs the guidelines for obtaining an ag exemption. It's also critical to understand the tailored support provided by the county to navigate this process successfully.

Local Agriculture and Economy

Gonzales County's economy is significantly influenced by its agricultural sector. Livestock, poultry, and crop production are pivotal, with cattle ranching and hay cultivation among the most prevalent activities. For landowners in this county, maintaining an agricultural exemption can lead to substantial property tax savings, provided their land is used primarily for agricultural purposes. Colorado County, while distinct, shares a similar focus on agriculture, and residents across both locales benefit from a strong understanding of regional agricultural practices.

County-Specific Guidelines and Support

The Gonzales Central Appraisal District provides the necessary forms and guidance for tax exemptions, including the agricultural exemption. To comply with county-specific guidelines, residents must:

File the appropriate documentation, such as Application for 1-d-1 (Open-Space) Agricultural Use Appraisal, with the Gonzales Central Appraisal District.

Understand that different levels of exemption could apply based on the percentage of land used for agriculture and the nature of the activities conducted.

Support can be found by visiting the district's office at 1709 E. Sarah Dewitt Drive, Gonzales, TX or by contacting them directly via phone for personalized assistance concerning agricultural exemptions. This support is crucial in navigating the nuances of Gonzales County's agricultural tax regulations.

Outreach and Education

The Gonzales Central Appraisal District prioritizes educating the community on agricultural exemptions through a variety of informative resources and programs. These initiatives aim to inform farmers and ranchers in Gonzales County about the intricacies of agricultural exemptions, ensuring they can fully benefit from available opportunities.

Workshops and Webinars

The district frequently organizes workshops and webinars that are designed to guide landowners through the exemption application process. Topics typically include:

How to complete exemption application forms

Deadlines for submission

Renewal procedures for Ag/Timber numbers, as mandated by Texas Comptroller Glenn Hegar

These sessions often feature experts and may sometimes include collaborations with organizations like the Future Farmers of America (FFA) to offer specialized education for younger audiences interested in agricultural practices.

Educational Material for Farmers and Ranchers

A wealth of educational materials is made accessible by the Gonzales Central Appraisal District to assist local farmers and ranchers. This material includes:

Printed guides and brochures

Online resources including videos and fact sheets

The content provided helps explain complex tax codes related to agricultural land and special appraisal options, such as the Wildlife Management Use Appraisal. Educational resources are continually updated to reflect current tax guidelines, ensuring that the farming community stays informed about compliance and benefits.

Related Categories for Tax Exemptions

In Gonzales County, Texas, property owners and agricultural producers may benefit from various tax exemptions that reduce their tax liability. These exemptions are specifically designed for homestead properties and for the purchase of farming supplies.

Homestead Exemption

Homestead exemptions in Gonzales County provide property tax relief to homeowners by removing part of the home's value from taxation, thus lowering taxes. To apply for a homestead exemption, homeowners must provide documentation such as a driver's license and, in some cases, complete an affidavit.

Sales Tax Exemption for Farming Supplies

Agricultural producers are eligible for sales tax exemptions on items used exclusively in the production of agricultural goods for sale. These items typically include:

Feed: Oats, hay, and other types of feed for livestock and wild game.

Seeds and Plants: Products used to produce food for sale.

Water: Water and other essentials used in agricultural operations.

To claim the exemption, farmers and ranchers must obtain an Agricultural and Timber Exemption Registration Number. This number is required when purchasing supplies to ensure the tax is not applied.

Additional Entities

In the context of agricultural exemptions in Gonzales County, Texas, a variety of entities and stakeholders are involved in the administration and utilization of these exemptions.

The Texas Comptroller of Public Accounts is the primary entity responsible for overseeing tax exemptions statewide, including those related to agriculture. Farmers and timber producers must obtain an Ag/Timber Number to claim exemption on certain purchases pertaining to agricultural and timber operations, such as feed, seeds, and farming equipment.

The Gonzales Central Appraisal District (CAD) handles the assessment of property values for tax purposes and determines eligibility for agricultural appraisals, which may impact property tax bills. Landowners seeking agricultural appraisal—sometimes referred to as ag exemption—must demonstrate that their land meets requirements for size, use, and intensity standards specific to agriculture or timber production.

Property owners may interact with the CAD through various means, including online services, mail, or in-person visits, to manage their exemptions, submit renewal letters, or engage with property tax assistance. For instance, information on maintaining agricultural land appraisal and rollback taxes—additional taxes incurred if land is diverted from qualifying agricultural use—is available through these channels.

Frequently Asked Questions (FAQs) sections and educational videos hosted by entities like the office of the Texas Comptroller Glenn Hegar can provide clarity on the complexities of exemptions and property taxes in Gonzales County.

Farmers and ranchers often inquire about minimum acreage requirements, animal units, and specific guidelines for different types of farming, from beekeeping to crop dusting and commercial nursery operations. Exemption certificates are critical for farmers to purchase items such as feed, hay, and seeds without sales tax.

For landowners involved in wildlife management, obtaining exemptions can offer tax savings, allowing for further investment in maintaining Texas's diverse ecosystems. Also, educational operations like Future Farmers of America programs may collaborate with local appraisal districts to promote agricultural education.

An important aspect includes the transition of property upon a seller's death. An Affidavit of Heirship may be necessary to facilitate the application for Texas title by a surviving spouse or heir. This ties into agriculture as farm property may span familial generations.

In conclusion, the interplay between various entities ensures that agricultural exemptions are properly managed and implemented, allowing Texas's agricultural sector to thrive under appropriate financial conditions, guided by the Texas Property Tax Code and enforced by county appraisal districts.