Harrison County TX Ag Exemption:

A Guide to Qualifying and Benefits

This Article is Part of Our Guide on the Ag Exemption in Texas

In Harrison County, Texas, agricultural producers are afforded the opportunity to reduce their property tax obligations through the agricultural exemption, which is a misnomer as it is actually a special method of appraising land based on its agricultural use rather than an outright exemption. This valuation approach is designed to support and encourage the agricultural industry by allowing farmland to be taxed based on its capacity to produce agricultural goods and not at market value, which can be significantly higher. Landowners who engage in timber production can also benefit from a similar provision known as the timber exemption.

To benefit from these provisions, landowners in Harrison County must adhere to specific regulations and requirements set by the Texas Comptroller of Public Accounts. Among them is the necessity to obtain an agricultural and timber registration number (Ag/Timber Number), which must be presented when purchasing items for agricultural and timber operations to qualify for the sales tax exemption. This number indicates that the landowner is operating within the scope of the state's tax code provisions related to agriculture and timber.

The appraisal cycle, as mandated by the Texas Property Tax Code, also plays a pivotal role in determining the valuation of properties within Harrison County. Reappraisals take place at least every three years to ensure the accuracy of valuations and to account for any changes in land use or productivity. This regular assessment ensures that both the agricultural industry and counties like Harrison maintain an equitable and just tax system that reflects the current state of land use and production.

Understanding Agricultural Exemptions

Agricultural exemptions in Harrison County, Texas, offer significant benefits to those in the farming and ranching sectors, including reductions in property tax obligations.

Eligibility for Agricultural Exemption

The agricultural exemption is available to landowners who utilize their land for farming or ranching purposes, thus influencing the valuation of their property under the property tax code. To qualify, a landowner must show that the land is primarily used for producing food or fiber, and must have been used continually for five years for agricultural purposes. Harrison County Appraisal District will assess eligibility based on current use and past activities.

Benefits of Agricultural Exemption

Agricultural exemption provides a property valuation based on the land's capacity to produce agricultural products rather than its market value. This results in a lower property tax assessment for qualifying landowners. For example:

Non-exempt Land Value: $15,000

Agricultural Value: $5,000

The taxable value would reflect the agricultural value, leading to potentially significant tax savings.

Eligibility for Timber Exemption

Landowners with timber-producing land can apply for a timber exemption. Similar to the agricultural exemption, the productivity of the timberland determines the property tax valuation. Eligibility requires active engagement in producing timber for commercial purposes and adhering to the guidelines set forth by the Texas Forest Service.

Application Process

When applying for an agricultural exemption in Harrison County, TX, individuals must accurately provide required documentation, understand the process for application, and have knowledge of timber registration and exemptions. The process is designed to verify eligibility for tax exemptions under agricultural use.

Required Documentation

To apply for an agricultural exemption, applicants must provide:

Proof of engagement in agricultural production for commercial purposes.

Identification and relevant ownership documents.

A completed application form, typically available through the Texas Comptroller's website or local agrilife extension offices.

Documentation must demonstrate that the agricultural land meets the necessary degree of intensity and primary use requirements established by the county officials.

How to Apply for Ag Exemption

The application process for an ag exemption in Harrison County involves the following steps:

Download the necessary forms: An Adobe Acrobat Reader is required to view and fill out the application form.

Complete the application: Fill the form with accurate and comprehensive details about your agricultural operations.

Gather required documentation: Attach all necessary supporting documents as specified in the form instructions.

Submit your application: The application can usually be submitted either by mail or online to the Harrison County Appraisal District.

Await confirmation: After submission, the comptroller or appraisal district reviews the application. If further information is needed, they will contact the applicant.

Applicants receive a registration number upon approval, which is used to claim tax exemptions.

Timber Registration and Exemptions

For timber exemptions, applicants must:

Verify that the land in question is used primarily for timber production which is intended for commercial sale.

Apply for a timber registration number through the same channels as the ag exemption, which in this case is specifically the Texas Comptroller's office.

Use the timber registration number to purchase items for timber production without paying sales tax.

Upon obtaining a timber registration number, applicants are issued an exemption certificate that is vital for any tax exemption claims related to timber production.

Contact Information and Resources

For those seeking details on agricultural exemptions in Harrison County TX, it is essential to know the appropriate contacts for acquiring information and assistance. The resources provided by the Harrison County Appraisal District and the Texas Comptroller are critical reference points.

Harrison County Appraisal District Contacts

Phone:

For inquiries regarding agricultural exemptions, one can contact the Harrison County Appraisal District via phone at 1-800-500-7074.

Email and Website:

Further information and resources can be accessed through their website or by sending an email. Unfortunately, specific contact details are not provided here.

Address:

Visitors looking to seek information in person can find the Harrison County Appraisal District located in Marshall, Texas.

Texas Comptroller Resources

Phone:

The Texas Comptroller of Public Accounts, tasked with overseeing taxes and state fiscal matters, can also provide assistance through their phone line at 1-800-262-8755.

Website and Forms:

A wealth of resources, including forms and guidelines regarding the Agricultural and Timber Exemptions, is available on the Texas Comptroller's website.

Email Address:

For specific questions regarding exemptions or taxes, individuals may contact the comptroller's office via the provided email address. Specific email addresses are not included here.

By utilizing these contacts and resources, taxpayers in Harrison County can efficiently navigate the intricacies of agricultural exemptions.

Managing Agricultural Lands

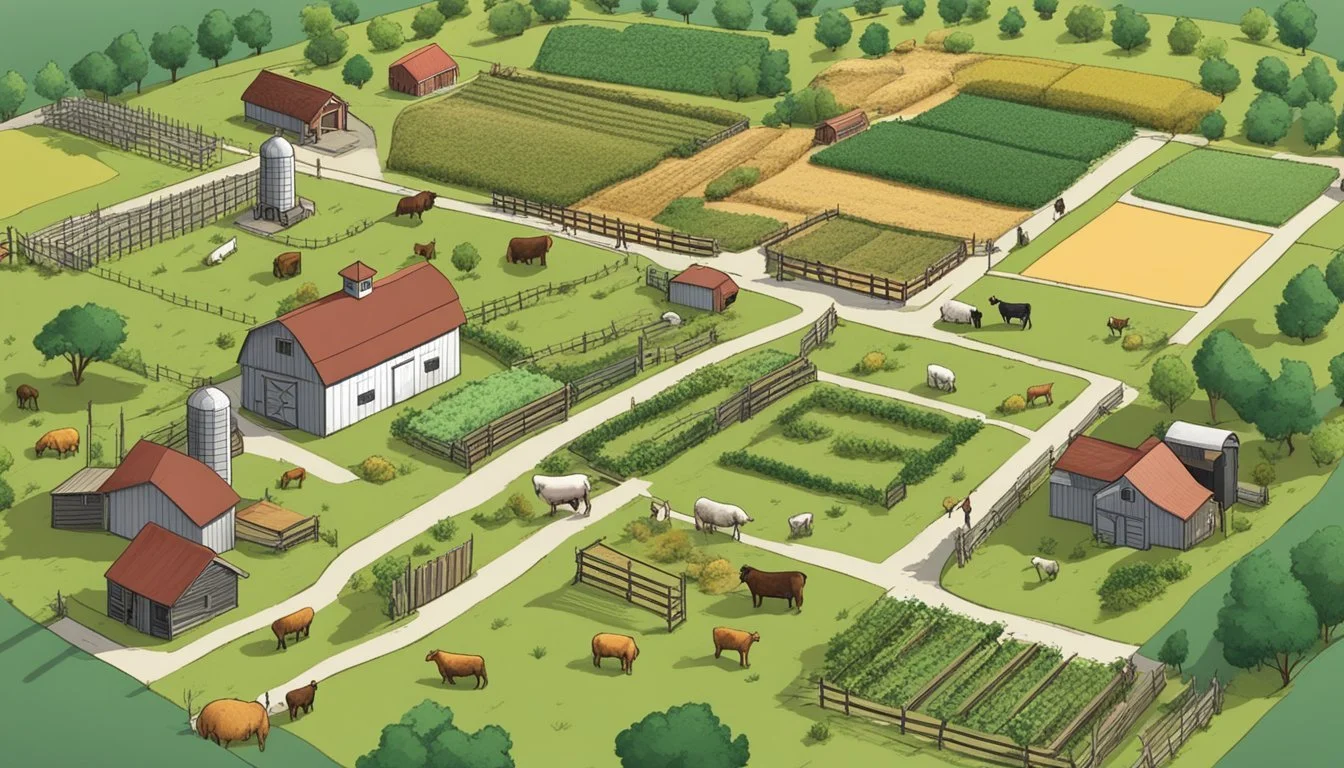

In navigating the agricultural exemptions of Harrison County, TX, landowners need to integrate best practices for land management and be aware of the variety of applications that qualify for ag exemption, including traditional agriculture and innovative wildlife and youth education programs.

Best Practices for Farming and Ranching

Farming and ranching are the backbone of agricultural land management. To ensure sustainability and efficiency, landowners should:

Implement rotational grazing systems to maintain livestock health and soil vitality.

Use drought-resistant crops to reduce water dependency.

Involve integrated pest management techniques to minimize chemical use.

Employ precision agriculture to optimize resource use and crop yields.

Wildlife Management as Agriculture

Agricultural land may also be managed for wildlife conservation purposes as part of the ag exemption if it contributes to sustaining a breeding, migrating, or wintering population of indigenous wild animals. Management activities can include:

Establishing habitat controls such as prescribed burning or brush management.

Providing supplementary supplies of water and food.

Erecting shelter and constructing nesting boxes.

4-H and Youth Training Programs

4-H and related youth training programs play a crucial role in the future of agriculture. They offer opportunities for family engagement and the development of the next generation through:

Hands-on educational workshops focusing on agriculture, livestock, crops, poultry, fish, and exotic animals.

Leadership training to cultivate skills in public speaking, decision-making, and project management.

Families are encouraged to participate in 4-H to ensure that youth gain practical experience, underpinned by a strong foundation of agricultural knowledge and stewardship principles.

Tax Considerations

In Harrison County, Texas, agricultural tax exemptions can offer significant benefits to eligible property owners. Understanding how property taxes are calculated, the specifics of sales tax exemptions for agricultural producers, and the rights afforded to taxpayers during the protest process are crucial to maximizing these financial advantages.

Understanding Property Taxes in Texas

Property taxes in Harrison County are established based on the assessed property values, which are informed by the Texas Property Tax Code. Agricultural land can be granted a special valuation that lowers tax liability by appraising the land based on its agricultural use rather than its market value. To qualify for this special valuation, landowners must actively use the land for agriculture and adhere to the specific guidelines set by local appraisal districts.

Sales Tax Exemption for Farmers and Ranchers

Farmers and ranchers in Harrison County may apply for a sales tax exemption on items used exclusively in agricultural production. To qualify, they must obtain an Ag/Timber Number from the Texas Comptroller's office, which confirms their eligibility based on the Texas Property Tax Code. The exemption can significantly reduce the cost of eligible items like machinery, feed, and seed. Here is a quick list of essentials:

Feed & Fertilizers: Essential nutrients for livestock or crops.

Machinery & Equipment: Vehicles and tools that directly aid in farming.

Seeds & Plants: Basic units to start crops or establish pasture.

Protest Process and Taxpayer Rights

Should property owners in Harrison County disagree with their assessed property values, the Texas Property Tax Code provides a protest mechanism. Property owners can challenge their assessments by filing a protest with the Harrison County Appraisal District. Deadlines are strict, so timely action is critical. Taxpayers retain the right to equal and uniform taxation and have access to detailed evidence used in determining property values.

File a Protest: Submit the required form before the deadline (usually May 15).

Review the Evidence: Request the information that supports the assessed value.

Prepare Your Case: Collect documentation that demonstrates a lower value.

Attend the Hearing: Present your evidence to the Appraisal Review Board (ARB).

Financial Management and Support

Managing finances effectively is crucial for agricultural businesses in Harrison County, TX. They can benefit from a range of support mechanisms designed to promote sustainable practices and economic viability within the ag-exemption framework.

Funding for Agricultural Businesses

Harrison County provides agricultural businesses with a variety of funding opportunities to support their operations and encourage growth. The emphasis is on maintaining the balance between economic development and conservation of natural resources.

Local Funding Resources: Agribusinesses can explore local funding resources, including grants and low-interest loans dedicated to agricultural enterprises.

Ad Valorem Property Tax System: The county utilizes an ad valorem property tax system that can offer lower tax rates on land designated for agricultural use, easing the budgets and operating expenses for farmers.

Local Funding Resources

Within Harrison County, entities including schools, cities, and districts have a vested interest in the success of local agriculture, which can lead to additional support mechanisms.

Schools: Educational programs may partner with agricultural businesses to offer both funding and practical support.

Districts and Cities: The local government districts and cities may have funds earmarked for promoting agricultural economic development, which could assist in meeting various regulatory and sustainability goals.

Each source of funding or support is structured to fit within the fiscal policies of Harrison County and the broader state's guidelines for agricultural operations.

Legal and Regulatory Compliance

In Harrison County, Texas, agricultural exemptions provide significant property tax benefits. It is critical for landowners to understand the Texas Property Tax Laws and adhere to Renewal and Compliance Requirements to maintain their ag exemption status.

Texas Property Tax Laws

The Texas Property Tax Code sets the framework for property tax exemptions. Agricultural landowners can apply for an agricultural exemption, which is actually a special valuation of their property—calculating taxes based on the agricultural use value rather than the market value. The Comptroller of Public Accounts, currently Glenn Hegar, oversees the application of these laws to ensure fairness and accuracy in taxation.

Relevant Entities:

Property Tax Code: Governs tax exemptions and valuations.

Glenn Hegar: The Comptroller of Public Accounts responsible for state tax collection and administration.

Renewal and Compliance Requirements

Landowners must renew their ag/timber number to continue to claim an agricultural exemption on qualifying purchases. Renewals take place every four years, with the current period expiring on December 31, 2023. Notices for renewal are mailed out, and landowners are responsible for submitting their renewals promptly to avoid penalties. Additionally, landowners must comply with specific requirements to maintain their exemption status, including the proper use of land and the timely payment of all applicable taxes, such as motor vehicle taxes if relevant.

Key Compliance Points:

Renewal: Ag/Timber numbers must be renewed every four years.

Property Tax Assistance: The Comptroller's Office offers assistance for complying with tax laws.

Motor Vehicle Taxes: Included if vehicles are used for agricultural purposes.

WebFile: An online system provided by the Comptroller for electronic tax filings and renewals.

Relevant Entities:

Renewal: Ensuring continued exemption benefits.

Franchise Tax: Not directly related to ag exemption but part of the tax system overseen by the Comptroller.

Motor Vehicle Taxes: May be applicable for vehicles used in agricultural operations.

Property Tax Assistance: Support provided by the Comptroller for tax-related inquiries and issues.

WebFile: A tool to facilitate online tax filings, including renewals.

Additional Support and Training

Farmers and timber producers in Harrison County, Texas, have access to a variety of educational resources and training programs designed to help them maximize their operations and maintain ag exemption status.

Texas A&M AgriLife Extension Programs

Texas A&M AgriLife Extension Service serves as a fundamental resource for the agricultural community in Harrison County. They provide systematic training sessions and materials that focus on the best agricultural practices, emerging technologies in the industry, and strategies to maintain land in accordance with ag exemption requirements. Workshops and seminars are delivered by experts in agriculture and natural resources, which can vary in format from in-person sessions to online webinars accessible through video resources.

Key offerings include:

Guided Courses: Structured learning modules on specific topics relevant to ag exemption management.

Online Resources: A catalog of articles, videos, and guides that cover a wide range of subjects.

Continuing Education for Farmers and Timber Producers

Continuous learning is critical for farmers and timber producers seeking to preserve their ag exemption status. The AgriLife Extension provides continuing education programs that cover legislative updates, advanced farming techniques, and sustainable practices. These programs ensure producers are well-informed and compliant with the latest guidelines and methods.

Continuing education formats include:

Periodic Newsletters: Informative updates and upcoming event announcements from the secretary's desk.

Certification Courses: Credentialed programs for more in-depth learning and qualification.