Palo Pinto County TX Ag Exemption

A Guide to Agricultural Tax Benefits

This Article is Part of Our Guide on the Ag Exemption in Texas

In Palo Pinto County, Texas, landowners involved in either agriculture or timber production have the opportunity to benefit from a valuation method that could potentially decrease their property tax burden. This is not a direct tax exemption but a special method of appraisal that evaluates land based on its agricultural use rather than on market value, commonly referred to as an "ag exemption." This assessment approach aims to support and incentivize agricultural operations by offering a more favorable tax treatment.

To participate in this program, landowners must ensure their property meets the state's definition of agricultural land and adhere to specific guidelines set forth by the State of Texas. The criteria involve the land being utilized primarily for agriculture within an intensity degree common for similar operations in the local area. Further, landowners must secure an agricultural and timber registration number (Ag/Timber Number) from the Texas Comptroller of Public Accounts to include on their certification documents when purchasing certain items for agricultural use.

The Palo Pinto County Appraisal District, an independent political subdivision, is responsible for appraising properties within the county for tax purposes and for determining the eligibility of properties for the agricultural valuation. This distinct method of assessment underscores Texas's commitment to preserving its agricultural heritage while also reflecting the current use and productivity of the land.

Understanding Ag Exemptions

Agricultural exemptions, known as "ag exemptions," in Palo Pinto County, Texas, offer significant tax benefits to landowners who actively use their property for agricultural purposes. It's essential to clarify that an ag exemption is not a direct tax exemption; instead, it provides a property tax reduction by valuing land based on its productivity value rather than its market or commercial value.

Under the Texas Property Tax Code, land that qualifies for an ag exemption is assessed based on the income it would generate through agricultural use—like crop production or livestock grazing—rather than the price the land would fetch if sold. This specialized appraisal can lead to considerably lower tax liabilities.

Criteria for Ag Exemption:

The land must be primarily used for bona fide agricultural purposes.

Activities must be routine, sustaining an agricultural endeavor over time.

Land must meet county-specific size and use guidelines.

Application Process:

Submit an application to the Palo Pinto County Appraisal District.

Provide evidence of agricultural productivity (e.g., grazing history, crop yields).

Await the district's assessment and decision.

Risks and Misconceptions:

Misunderstanding the scope of an ag exemption might lead to compliance issues.

If land use changes, landowners must report alterations that could affect their exemption status.

Land in Texas without an ag exemption is taxed at its market value, which considers potential uses beyond agriculture. A property's market value typically exceeds its productivity value, leading to higher taxes without the benefit of an ag exemption. Therefore, this agricultural appraisal provides an incentive to maintain the land's agricultural productivity, contributing to the preservation of Palo Pinto County's rural and agricultural heritage.

Eligibility Requirements for Ag Exemption

Before diving into the specifications, it's important to note that in Palo Pinto County, TX, eligibility for an agricultural exemption is contingent upon the property’s use for agricultural activities, the size and utilization of the land, and the possibility of including wildlife management as a form of agricultural use.

Qualifying Agricultural Activities

In Palo Pinto County, agricultural exemptions are granted to lands primarily used for bona fide agricultural purposes. This includes the production of crops, raising livestock, poultry, and fish, as well as engaging in forestry or timber production. The use must be an integral part of the agricultural operation and not merely incidental. Landowners involved in exotic animal husbandry or agricultural conservation practices may also qualify.

Minimum Acreage and Use Requirements

The land in question must meet specific size and use criteria to be eligible for an agricultural exemption. There are no explicit minimum acreage requirements stated; however, the land must show evidence of regular and sustained use for agricultural purposes. This use must reflect the degree of intensity typical for agricultural operations in Palo Pinto County. For example, timber land would typically involve regular planting and harvesting cycles, while land used for cattle farming may require rotation grazing practices to meet the eligibility criteria.

Wildlife Management as Agricultural Use

Palo Pinto County also recognizes wildlife management as a qualifying agricultural use under certain conditions. Landowners can apply this designation when activities such as habitat control, erosion control, predator control, and providing supplemental supplies of water and food are conducted with the intention of sustaining a breeding, migrating, or wintering population of indigenous wild animals. These practices must be part of a purposeful effort to conserve wildlife and promote biodiversity, aligning with the principles of natural resource management.

Application Process for Ag Exemption

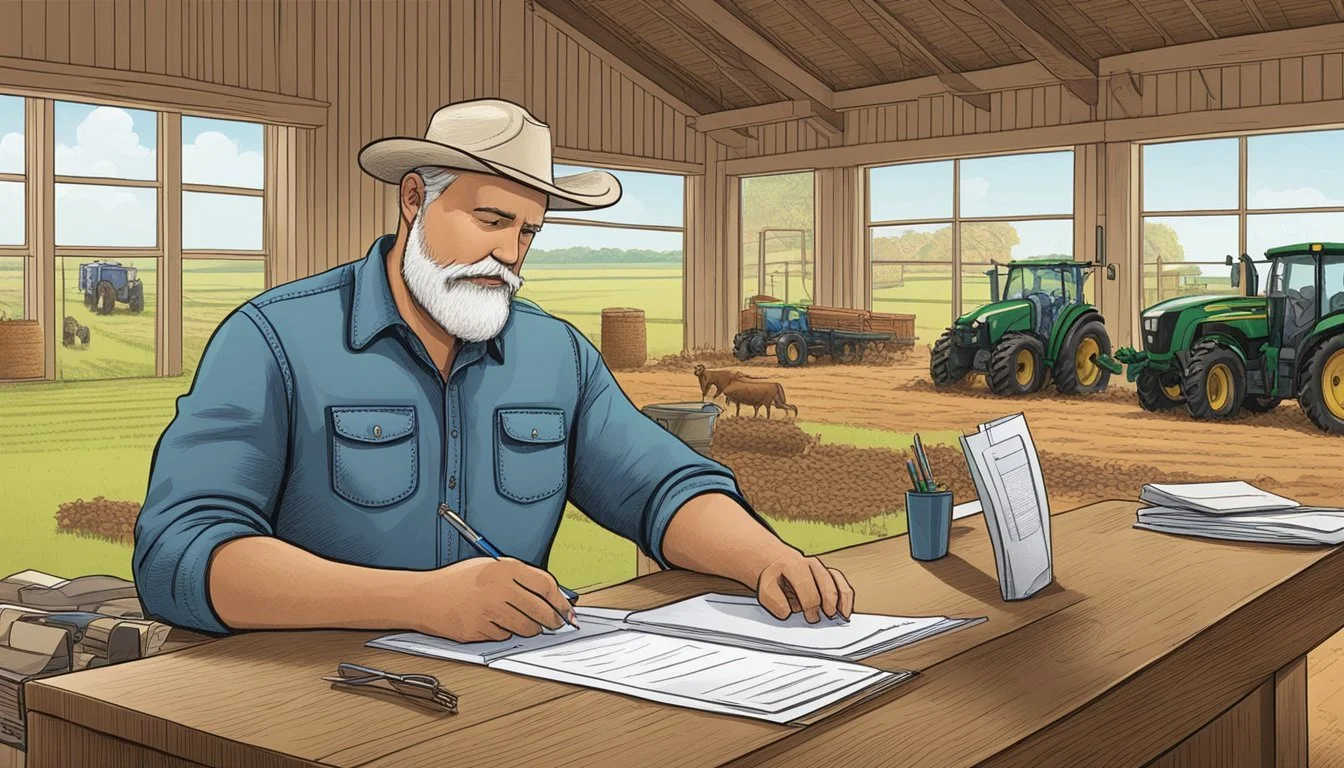

When seeking an agricultural exemption in Palo Pinto County, Texas, applicants must follow a structured process to obtain and maintain their exemption status. Proper documentation, completing registration procedures, and regularly communicating with the Palo Pinto Appraisal District are crucial steps.

Required Documentation

Obtaining an agricultural exemption requires specific documents:

A completed application form, readily available as a PDF document, which can be opened using Adobe Acrobat Reader.

Proof of agricultural use of the land, which could include historical data or current lease agreements.

Registration and Renewal Procedures

Applicants must:

Apply for an Ag/Timber Number:

This can be done online or via mail.

The registration number is essential for tax exemption claims on qualifying purchases.

Renewal:

The Ag/Timber Number has an expiration date and must be renewed periodically.

Renewal can typically be managed online through the Texas Comptroller’s website or by contacting them directly.

Contacting the Appraisal District

By phone: The Palo Pinto Appraisal District can assist with queries and clarifications.

In person or by mail: Applicants can contact or visit the appraisal district for hands-on assistance.

The Palo Pinto Appraisal District's contact details and operating hours are available on their website.

Financial Implications of Ag Exemptions

Ag exemptions in Palo Pinto County can lead to considerable financial benefits through tax savings but also come with certain responsibilities that could incur costs, such as rollback taxes, should the land use change.

Tax Benefits and Savings

In Palo Pinto County, agricultural exemptions primarily affect property taxes, potentially lowering the tax burden for landowners. Property is typically taxed based on market value; however, with an agricultural exemption, it is appraised based on the land's ability to produce agricultural products, which is often significantly lower. Consequently, taxes are also reduced. The savings can greatly impact landowners' budgets and operating expenses, enabling them to invest more into their agricultural operations.

Reduction in Property Taxes: Property tax bills are minimized due to the lower appraisal rate.

Budgetary Relief: Lower taxes result in better cash flow for farmers and ranchers.

Rollback Taxes and Penalties

If a landowner changes the use of the property that no longer qualifies for the agricultural exemption, Palo Pinto County is obliged to charge rollback taxes. Rollback taxes are the difference between taxes based on the agricultural value and taxes based on the market value for the last five years. This ensures that the county recoups some of the revenue lost during the years the land had an ag exemption.

Potential Penalties: Includes the rollback tax plus interest, which can significantly impact the landowner’s finances.

Property Values and Budget Considerations: Changing land use could lead to a reassessment at a higher market value, resulting in not only higher property taxes going forward but also rollback taxes that can substantially affect a landowner's budget.

Understanding both the advantages and the obligations of agricultural exemptions is crucial for Palo Pinto County landowners to make informed decisions about their land use and manage their finances accordingly.

Other Benefits and Considerations

In addition to the tax valuation benefits that come with an agricultural exemption in Palo Pinto County, property owners should be aware of further advantages and necessary measures that play a role in maintaining the exemption status.

Environmental and Conservation Incentives

Property owners with an ag exemption are encouraged to engage in practices that support environmental conservation. For instance, they may be eligible for programs that offer assistance for water conservation or feed management to maintain sustainable agricultural operations. These incentives are designed to foster an environmentally friendly approach to agricultural practices, ensuring long-term viability of the resources.

Additional Exemptions and Financial Support

Beyond property tax reductions, those with an agricultural exemption in Palo Pinto County might qualify for:

Sales tax exemptions on certain items essential for their agricultural operation, including machinery or feed, by presenting their exemption certificate at the point of purchase.

Financial programs that support training and development for improved agricultural practices, which can lead to increased efficiency and productivity.

It is important for landowners to keep up to date with the specific criteria and application processes for these benefits to ensure they utilize all available support while complying with regulatory requirements.

Important Contacts and Resources

For agricultural exemptions in Palo Pinto County, stakeholders should familiarize themselves with several key contacts and resources to navigate the specifics of property taxation and exemptions.

Palo Pinto County Appraisal District: Address: 109 W. FM 1821, Mineral Wells, TX 76067

Phone: (940) 325-2434

Website: Palo Pinto County CAD

This office is responsible for the appraisal of properties within Palo Pinto County and can provide guidance and application forms for agricultural exemptions.

Texas Comptroller of Public Accounts - Glenn Hegar: Phone: (800) 252-5555

Website: Texas Comptroller

The Comptroller's office can assist with state tax regulations, including the statewide renewal of Ag/Timber registration numbers, and offers online services through WebFile.

Texas Franchise Tax: Phone: (800) 252-1381

Website: Franchise Tax Information

For questions regarding the Texas Franchise Tax as it pertains to agricultural operations, contact this department for specific information.

Property Tax Assistance Division (PTAD): Phone: (800) 252-9121

Email: pta.web@cpa.texas.gov

Website: Property Tax Assistance

PTAD provides resources and assistance for understanding property tax benefits related to agricultural land valuation and exemptions.

For assistance with online filing and services, the WebFile system offers a convenient electronic method for managing taxes and exemptions. Website: WebFile

Palo Pinto residents are encouraged to reach out to these offices and utilize provided web resources for clear guidance on maintaining their agricultural exemptions.

Local Impact and Community Contributions

In Palo Pinto County, the agricultural (ag) exemption plays a significant role in shaping the local economic landscape. The ag exemption is part of the wider ad valorem property tax system which affects not just farmers, but the entire community, including schools, cities, and districts.

Local Area: The ag exemption directly impacts the county's economy by lowering the tax burden on farmers, which can lead to increased investment in farming activities. This, in turn, can enhance production and contribute to local food supply stability.

Schools: Property assessments under the ag exemption can affect local funding for schools, as they often rely on property taxes for a portion of their revenue. A balance must be struck to ensure that while supporting agricultural pursuits, schools receive adequate funding.

Purchasing: Farmers utilizing the ag exemption influence the local purchasing power by investing in farm-related products and services. This encourages a cycle of financial activity within Palo Pinto County.

Property Tax Impact:

Decreased property taxes for qualifying farmers

Potential reevaluation of funding allocation for public resources

Community Contributions:

Enhanced economic activity through farming investments

Stable local employment in agricultural sectors

Cities and Districts: Municipalities and districts within Palo Pinto County are tasked with managing the implications of the exemption, ensuring that the benefits to individual farmers do not disproportionately affect community services funded by property taxes.

Through careful management and ongoing community dialogue, Palo Pinto County aims to harness the ag exemption as a tool for sustainable development, recognizing the needs of both its agricultural community and the wider population.