USDA Loans Georgia

Your Guide to Affordable Home Buying

USDA loans offer a valuable resource for individuals and families seeking homeownership in the more rural and suburban areas of Georgia. These loans are aimed at promoting prosperity by making home buying more accessible to moderate-income earners. In essence, a USDA loan provides an opportunity for eligible buyers to secure 100% financing, which means no down payment is required, making the path to homeownership more attainable for those who may otherwise face financial barriers.

In Georgia, the availability of USDA loans extends beyond the hustle of major urban centers like Atlanta, Augusta, Columbus, and Macon, reaching into the quieter parts of the state. By design, these loans encourage growth and stability in rural communities. The USDA Rural Development Guaranteed Housing Loan Program, which backs these loans, does more than just facilitate the purchase of homes; it invests in the development and longevity of these areas. This government-sponsored program assesses applicants based on location, income, and other criteria to ensure loans are granted to those who are most in need of assistance in becoming homeowners.

Furthermore, applying for a USDA loan in Georgia is more accessible than ever with online self-assessment tools and a network of approved lenders, including mortgage companies, banks, and credit unions. Prospective homeowners can easily gather information on their eligibility and the requirements of the loan process. With such resources at their disposal, Georgia residents are well-positioned to explore and take advantage of what USDA loans have to offer for their homeownership goals.

USDA Loans Overview

USDA loans, backed by the United States Department of Agriculture (USDA) Rural Development, are designed to support homebuying in rural areas, offering benefits like zero down payments.

What Are USDA Loans

USDA loans are mortgage solutions offered by the USDA Rural Development to promote homeownership in designated rural areas. They provide support to eligible applicants—typically low- to moderate-income individuals or families—allowing access to affordable housing opportunities. Lenders across Georgia participate in these programs, following guidelines set by the USDA.

Benefits of USDA Loans

The main benefits of USDA loans include:

$0 Down Payment: Borrowers may be eligible for no down payment, which reduces the upfront costs of purchasing a home.

Competitive Interest Rates: Interest rates for USDA loans are often lower than conventional mortgage rates, making monthly payments more affordable.

Flexible Credit Guidelines: The credit requirements for USDA loans are generally more lenient compared to traditional mortgage options.

Eligible borrowers can take advantage of these benefits, provided they meet the USDA’s criteria for income and the property's location.

Types of USDA Loans

There are primarily two types of USDA home loans:

USDA Guaranteed Loans: Offered by USDA-approved lenders, this program is designed for moderate-income applicants. Here, the USDA guarantees a portion of the loan, reducing risk to lenders.

USDA Direct Loans: Also known as the Section 502 Direct Loan Program, these loans are directly funded by the USDA and assist low- and very low-income applicants. They offer the additional benefit of payment assistance to enhance the borrower’s repayment ability.

Both programs require the property to be located in an area deemed rural by the USDA, which recently completed a review based on the 2020 decennial United States census.

Eligibility Criteria

To secure a USDA loan in Georgia, potential homeowners must meet specific criteria relating to their credit score, income, and the property they aim to purchase. These requirements are established to ensure that applicants are capable of repaying the loan and that the properties supported are within designated rural areas.

Credit Score Requirements

Minimum Credit Score: Lenders typically look for a credit score of 620 or above for applicants seeking 100% financing on a home.

Past Credit Events: Applicants with a history of credit difficulties, including bankruptcy, short sale, or foreclosure, may still be considered but could face additional requirements.

Income Limits

Adjusted Household Income: An applicant’s adjusted household income must be at or below the applicable low-income limit for the area where the property is located.

Debt-to-Income Ratio (DTI): Lenders will assess the housing-related DTI, as well as the total DTI, to gauge an applicant’s ability to repay debt.

Property Eligibility

Designated Rural Area: The home must be situated in an area that is considered an eligible rural area as per USDA definitions.

Safe and Sanitary Housing: Applicants must be in need of decent, safe, and sanitary housing to qualify. Certain areas that have been reclassified from rural to non-rural are no longer eligible for these programs.

Application Process

When applying for a USDA home loan in Georgia, the process involves finding an approved lender, obtaining pre-approval, and completing the loan application. These steps ensure that applicants are well-prepared and meet the necessary criteria for loan approval.

Finding a USDA-Approved Lender

The first step in the application process is to find a lender that is approved by the USDA. An applicant can search for USDA-approved lenders in Georgia who are eligible to offer USDA home loans. The USDA maintains a list of approved lenders to assist applicants.

Pre-Approval

After choosing a lender, obtaining pre-approval is crucial. The pre-approval process involves the lender reviewing the applicant's financial information, such as income, assets, and credit history. This step helps determine the applicant's eligibility and the amount they are qualified to borrow. It's important for an applicant to secure pre-approval before shopping for a home to clearly understand their budget.

Loan Application

Once pre-approved, the applicant can then complete the official loan application. The application must include personal information, financial statements, and details about the home purchase. The lender will then process the application, which may include ordering a property appraisal and conducting a full credit and income review. If the application meets USDA guidelines and the lender's criteria, the loan can proceed to closing.

Financial Considerations

When exploring USDA loans in Georgia, applicants should carefully review the costs involved, including loan fees and interest rates. Understanding the structure of down payments, closing costs, and the availability of payment assistance can significantly impact the affordability and suitability of a USDA loan for prospective homeowners.

Loan Costs and Fees

USDA loans offer the advantage of having no down payment, allowing borrowers to finance up to 100 percent of the property's appraised value. However, there are still some costs to consider. A one-time guarantee fee is required, which is 1% of the loan amount and can typically be rolled into the loan. Additionally, there is an annual fee of 0.35% of the loan balance. These fees contribute to the continued viability of the USDA loan program.

Down Payment and Closing Costs

One of the most significant benefits of the USDA loan is the possibility of zero down payment, which alleviates the substantial upfront cost often associated with purchasing a home. Closing costs can vary, but they generally include loan origination fees, title searches, title insurance, surveys, taxes, deed recording fees, and credit report charges. Though not required, borrowers have the option to pay closing costs out-of-pocket if they choose.

Interest Rates and Payment Assistance

The USDA loan typically comes with 30-year fixed rates, providing stability in monthly payments. Interest rates for USDA loans are generally competitive with conventional loan rates, often resulting in more affordable lending options for the borrower. Additionally, the USDA offers payment assistance to help reduce the monthly payments for a short time, making the mortgage more manageable for low- and very-low-income applicants. This assistance effectively reduces the overall interest rate for the borrower during the assistance period.

Property Requirements

USDA loans in Georgia offer a path to homeownership in designated rural areas, catering specifically to single family housing direct loan programs. Understanding property requirements is essential for applicants considering a USDA loan.

Eligible Rural Areas

Georgia has numerous regions that qualify for USDA loans, defined as rural by the USDA. These eligible areas generally exclude major cities and urban regions, focusing instead on rural housing zones. Prospective homebuyers can check the official USDA website or contact a USDA loan expert to determine if a specific location is classified as a USDA eligible area.

Rural areas: Must be recognized by the USDA as eligible for rural housing loans.

USDA eligible area: Potentially includes most areas outside of major cities in Georgia.

Types of Properties

USDA loans are tailored for single-family housing direct builds. The property must be the applicant's primary residence, and they must not own suitable housing at the time of application.

Single family housing direct: Only properties that will serve as the primary residence for the borrower.

Types of eligible properties: Includes new constructions, modular homes, and certain HUD-approved condos.

Comparing USDA Loans to Other Mortgage Options

When assessing the landscape of mortgage options available in Georgia, USDA loans stand out for their benefits to certain homebuyers. This section will directly compare USDA loans with FHA and conventional loan options and discuss specific advantages for first-time home buyers.

USDA vs FHA Loans

USDA loans differ significantly from FHA loans in several areas. Firstly, USDA loans offer 100% financing, meaning no down payment is required, whereas FHA loans typically require a minimum of 3.5% down. USDA loans require the property to be located in an eligible rural or suburban area, whereas FHA loans do not have this geographic restriction. Furthermore, USDA loans have lower mortgage insurance costs compared to FHA loans, which can carry higher upfront and annual mortgage insurance premiums.

USDA vs Conventional Loans

When comparing USDA loans to conventional loans, the most notable difference is the down payment requirement. Conventional loans often require a minimum down payment of about 3% to 5%, but for higher loan-to-value ratios, this can rise significantly. In contrast, USDA loans do not require a down payment. Additionally, the borrower's credit score can be lower for USDA loans without significantly affecting the interest rate, a flexibility not always found in conventional loan terms. Lastly, USDA loans offer reduced mortgage insurance premiums compared to conventional loans which charge private mortgage insurance (PMI) based on credit score and down payment size.

Benefits for First-Time Home Buyers

First-time home buyers in Georgia may find USDA loans especially attractive due to the minimal financial barrier to entry – no down payment and lower mortgage insurance. This benefit directly contrasts with conventional loan requirements which often pose higher upfront costs. Moreover, USDA's relaxed credit requirements may bode well for first-time buyers who have not had the opportunity to build strong credit histories. The possibility for the seller to cover closing costs can further alleviate the initial financial load for the buyer.

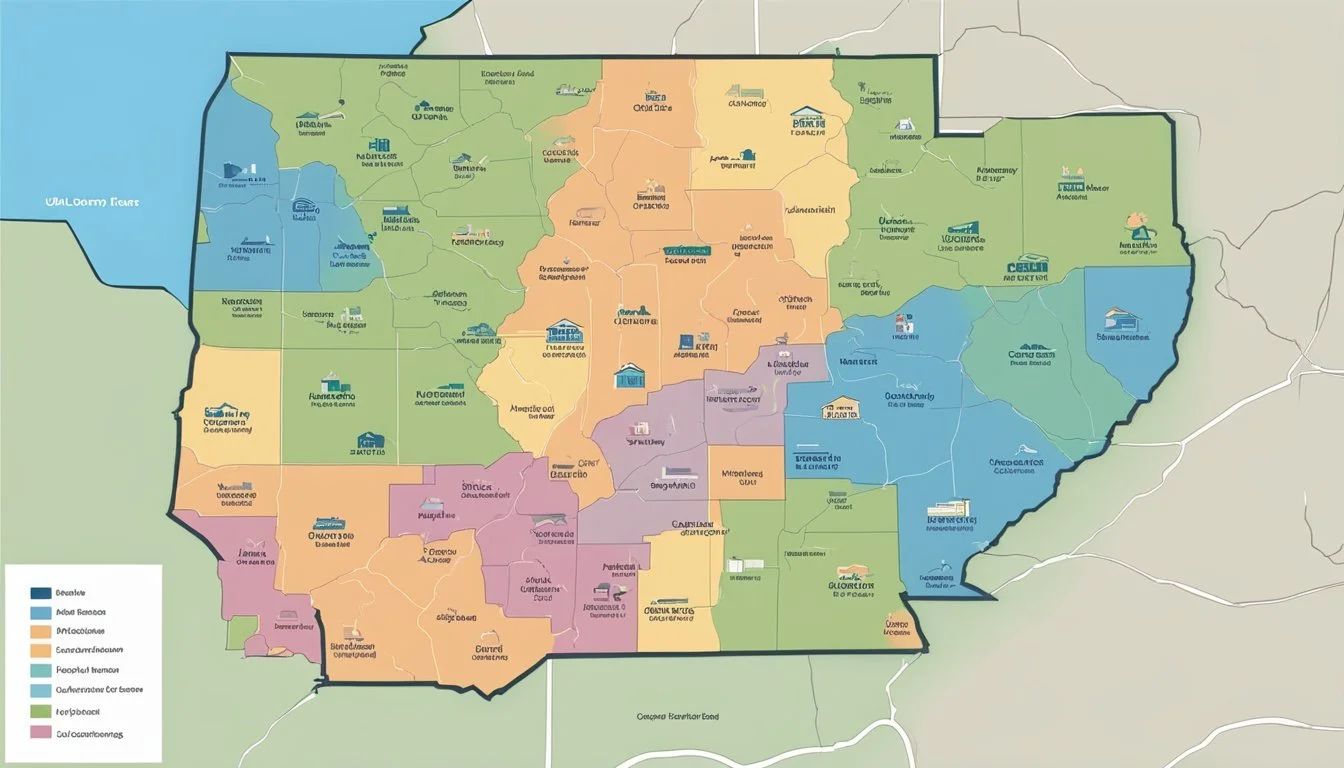

Key Locations for USDA Loans in Georgia

In Georgia, USDA loans are primarily available to help boost homeownership in its rural areas. However, the outskirts of larger cities may also be eligible. Here's an overview of key locations within the state where USDA loans are applicable.

Atlanta Area

Outside the immediate urban center of Atlanta, certain suburban and rural communities qualify for USDA loans. These loans are targeted at fostering homeownership where it’s most needed, ensuring that residents can access zero down payment mortgage options.

Athens Area

The Athens region, known for its collegiate atmosphere, also includes rural zones. Prospective homeowners in these outlying areas of Athens can take advantage of USDA loans to facilitate affordable housing away from the city's core.

Macon Area

Macon, an area rich in history and culture, is surrounded by eligible rural communities for USDA loans. Borrowers in these parts can utilize the benefits of USDA loans to own homes with generous terms, such as low-interest rates and no down payment.

Savannah Area

Savannah's charm extends into its rural outskirts where USDA loans can play a pivotal role in helping individuals and families acquire homes. These loans are especially valued in the quieter, less developed regions around Savannah for their affordability and accessibility.

Lender Information and Resources

When seeking a USDA loan in Georgia, potential homeowners have access to a network of approved USDA lenders. These lenders are knowledgeable about the USDA loan process and can provide the necessary resources and assistance to help borrowers secure financing for their rural homes.

List of USDA-Approved Lenders

Guaranteed Rate: This lender offers competitive rates for USDA loans and has a track record of assisting borrowers with the application process and understanding the terms of their mortgage.

Flagstar Bank: As a recognized institution, Flagstar Bank provides USDA loans to eligible rural homebuyers, ensuring compliance with USDA standards and regulations.

PNC Bank: Known for its customer service, PNC Bank caters to those interested in USDA rural loans by providing detailed guidance through the lending process.

Guild Mortgage: With specialized knowledge in government-backed loans, Guild Mortgage is another option for those looking for USDA loans, offering personalized service to meet individual housing needs.

Truist: This lender combines resources and expertise to support applicants in navigating USDA loan requirements, aiming to help borrowers achieve their goal of homeownership in rural areas.