USDA Loans Maryland

Your Guide to Rural Home Financing Options

USDA loans in Maryland offer a valuable resource for individuals looking to purchase a home in rural areas of the state. These loans are backed by the United States Department of Agriculture and are designed to foster homeownership for low- to moderate-income families. Through various loan programs, the USDA provides opportunities for eligible borrowers to obtain housing without the need for a large down payment, which is often a significant barrier to homeownership.

One of the primary benefits of a USDA loan is the potential for 100% financing, allowing purchasers to buy a home without a traditional 20% down payment. The program also offers competitive interest rates and terms, aiming to make monthly payments affordable. In Maryland, USDA Rural Development offices handle inquiries and applications, offering assistance to those who meet the income and property eligibility requirements.

A key feature of the program is payment assistance, which can reduce mortgage payments for a certain period, thus improving an applicant's repayment ability. This assistance makes it possible for individuals and families with lower income to qualify for a home loan that they might otherwise be unable to afford. The goal is to promote economic stability and improve the quality of life in rural communities throughout Maryland.

Understanding USDA Loans in Maryland

USDA loans provide Maryland residents with opportunities for homeownership in rural areas while supporting the state's significant agricultural economy.

Overview of USDA Loan Programs

The United States Department of Agriculture (USDA) administers loan programs designed to foster rural development and provide financial assistance to homebuyers in less densely populated areas of Maryland. USDA loans are a beneficial resource for qualifying residents, aiming to make homeownership more accessible and affordable.

In Maryland, the USDA Rural Development loan is primarily available in two forms:

USDA Guaranteed Loan Program: This is where the USDA guarantees a loan provided by a local lender, reducing the risk for the lender and enabling more favorable terms for the borrower.

USDA Direct Home Loan Program: This program applies to borrowers with low to very low income, where the loans are issued directly by the USDA.

Eligibility for these programs is predicated on several criteria:

Income Limit: Applicants must have an income that falls below a certain threshold, typically defined as 115% or less of the area's median income.

Credit Score: While the requirements can vary, a credit score of 640 or higher is often recommended for the guaranteed loan program.

Rural Area: The property must be located in an area classified as "rural" by the USDA.

Role of Agriculture in Maryland's Economy

Agriculture plays a significant role in the economic structure of Maryland. As a state with diverse agricultural production, from poultry and dairy to corn and soybeans, (how long do soybeans last?) supporting rural development is vital. USDA loans in Maryland not only assist homebuyers but also stimulate rural economies by enabling individuals to live and work in these areas.

Economic Contribution: Maryland's agriculture contributes significantly to the state's economy, providing employment and business opportunities.

Support through USDA Loans: By encouraging homeownership in rural areas, USDA loans help maintain the vitality of these communities, ensuring that agriculture continues to thrive.

By aligning the USDA loan programs with the needs of rural Maryland, the USDA promotes the well-being of both individuals and the larger agricultural sector. Through this synergy, the USDA strengthens the socio-economic fabric of rural Maryland.

Eligibility Requirements

USDA loans in Maryland offer unique benefits such as no down payment, but they come with specific eligibility requirements that borrowers must meet. These include criteria related to the location and income limits for the residential property, as well as the borrower's creditworthiness.

Residential and Income Eligibility

For a property to qualify for a USDA loan in Maryland, it must be located in an area designated as rural by the USDA. Borrowers’ adjusted household income must also fall within the program's specified limits, which, in Maryland, depend on the household size and county. For example, as of May 4, 2020, a 1-4 person household’s typical income limit is $90,300, while a 5-8 person household has an income limit of $119,200 in a majority of U.S. counties. These figures represent the maximum gross monthly income a household can earn to be eligible.

Eligibility Criteria:

Location: The property must be in a USDA-eligible rural area.

Household Income: 1-4 person households: $90,300; 5-8 person households: $119,200 (as of May 2020, subject to change).

Credit Score and Debt-to-Income Ratio

The credit score requirement for a USDA loan in Maryland, while not firmly fixed, usually favours a score of 640 or above. This facilitates automatic underwriting, although applicants with lower scores may still be considered on a manual underwriting basis, depending on the lender's guidelines. The debt-to-income (DTI) ratio is another critical financial parameter. Ideally, borrowers should have a DTI ratio of no more than 41%. However, higher ratios may be acceptable with strong credit profiles.

Financial Criteria:

Credit Score: Preferred minimum of 640.

Debt-to-Income Ratio: Should not exceed 41%.

These eligibility criteria help ensure that USDA loans assist those whom the program was designed to serve, making homeownership accessible and affordable for low- to moderate-income families in the rural regions of Maryland.

Loan Application Process

The USDA loan application process in Maryland is designed to assist eligible individuals with acquiring decent and safe housing in approved rural areas. The process is straightforward and can be initiated online.

How to Apply for a USDA Loan

To apply for a USDA loan, an applicant must ensure that they meet the income and credit guidelines specific to Maryland. These loans are aimed at assisting low- and very-low-income individuals. Alongside income eligibility, the property itself must qualify as rural according to the USDA's definition.

Step 1: Check eligibility requirements for both personal income and property location.

Step 2: Gather necessary documentation, such as proof of income, employment verification, and credit history.

Step 3: Contact a USDA-approved lender in Maryland and complete their preliminary application process.

Step 4: Once pre-approved, search for eligible properties within the designated rural areas.

Step 5: Submit a full application through the lender, who will guide the applicant through the USDA loan process.

Documentation and Online Application

The documentation required for a USDA loan application is crucial for assessing an applicant's qualification for the loan program. Applicants will need to provide:

Personal Identification: Such as driver's license or passport.

Income Verification: Pay stubs, tax returns, and W-2s from the past two years.

Credit History: Including credit scores and complete credit report.

The USDA has an online application system in place that allows for direct loan customers to submit their applications electronically. It streamlines the process and enables faster processing than traditional paper applications.

Online Submission: Access the USDA online application platform and follow the prompts to enter all required information.

Lender Review: A USDA-approved lender reviews the application, appraisal, and any additional necessary items.

USDA Approval: The completed file is then sent to Maryland's USDA office for final approval. Once approved, the lender coordinates with the escrow company to prepare for closing.

Types of USDA Loans

In Maryland, the United States Department of Agriculture (USDA) provides two primary types of loans suited for low-to-moderate income homebuyers in rural areas: Guaranteed Loans and Direct Loans. Each type caters to different income levels and has distinct eligibility requirements.

USDA Guaranteed Loans

The USDA Guaranteed Loan Program works with local lenders to extend loans to potential homebuyers. The USDA guarantees a portion of these loans, reducing the risk for lenders and enabling better loan terms for borrowers. Under the guaranteed loan guidelines:

Maximum Loan Amount: Not limited by the USDA but is based on the applicant's repayment ability.

Income Limits: Applicants may have an adjusted household income of up to 115% of the median family income for the area.

Eligibility: Borrowers must meet certain credit and income requirements to qualify.

USDA Direct Loans

USDA Direct Loans are funded directly by the USDA and are designed for low-income applicants:

Maximum Loan Amount: Varies based on county and individual financial circumstances.

Income Limits: Typically lower than those for Guaranteed Loans, focusing on applicants typically below 80% of the median area income.

Eligibility: These loans are targeted at families who have a significant need for housing assistance. Applicants must meet specific income and credit guidelines.

Both loan programs require the property to be located in an eligible rural area and serve as the primary residence of the borrower.

Financial Benefits

USDA loans in Maryland provide significant advantages for those seeking to purchase a home, including cost-saving measures that remove two major financial hurdles: the initial down payment and expensive closing costs.

No Down Payment Options

USDA loans stand out by offering 100% financing mortgage options to qualified borrowers. This exceptional opportunity eliminates the need for a down payment, allowing individuals to use their savings for other expenses or investments. Especially for first-time homebuyers in Maryland, the no down payment requirement represents a substantial financial benefit that can accelerate the path to homeownership.

Closing Costs and Interest Rates

Moreover, these loans can offer flexibility with closing costs. Sellers can pay closing costs, or in some cases, it's possible to roll them into the mortgage payment. Additionally, USDA loans typically come with competitive interest rates that can be lower than those available from conventional or FHA loans, further contributing to lower monthly mortgage payments for borrowers.

Property Eligibility and Requirements

Understanding which properties qualify for USDA loans in Maryland is crucial for prospective homeowners interested in rural development and homeownership. Specific requirements must be met in terms of the property's location and intended use.

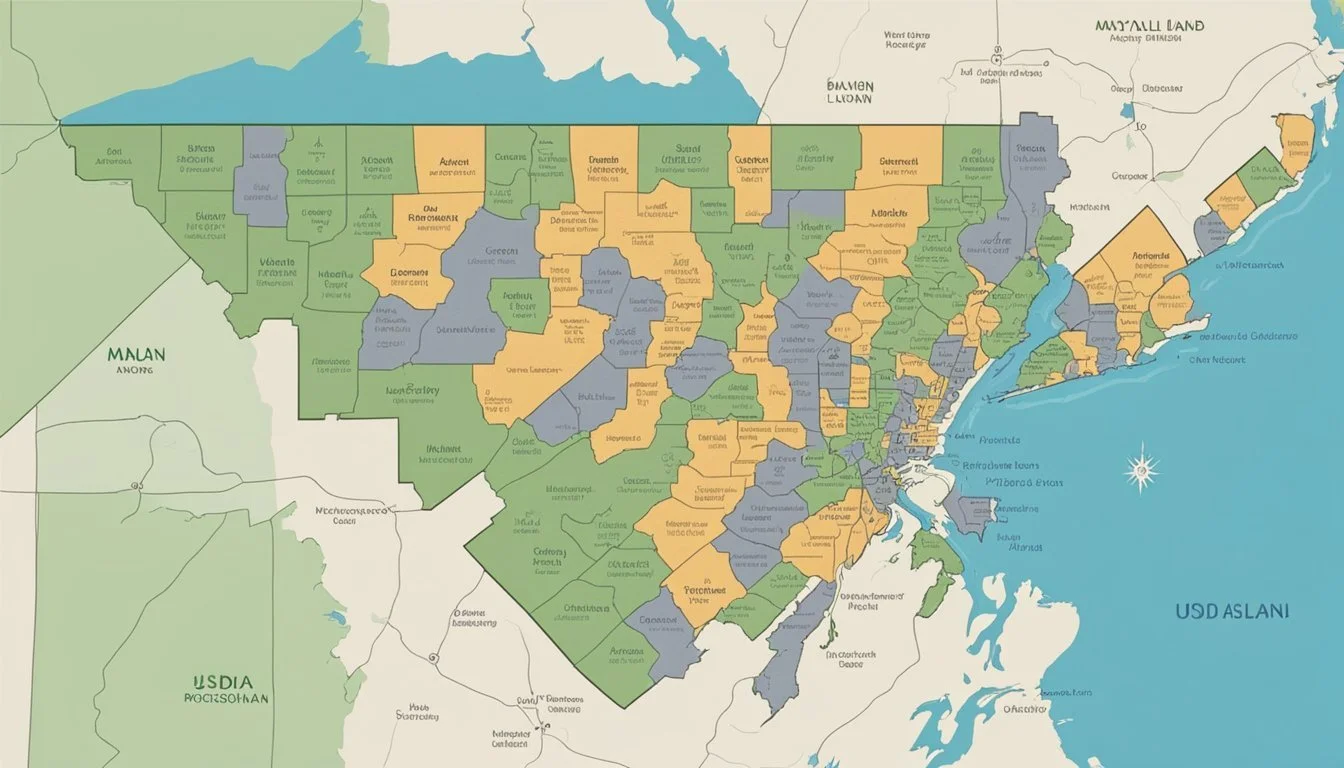

Identifying Eligible Rural Areas

Eligible rural areas for USDA loans are designated by the United States Department of Agriculture. A property must be located within these specified areas to qualify for funding. They are generally defined as communities with a population of 35,000 or fewer people. These areas often qualify for rural housing loans, which aim to encourage development in less densely populated regions.

Property Types and Use

The types of properties eligible under USDA loans in Maryland include:

Single-family residences: These homes must be used as the primary residence of the borrower.

Manufactured homes: Such homes are eligible if they are new and meet specific HUD standards.

Rural home sites: Land on which a new home will be built.

To support homeownership in rural areas, the property must not be an income-producing farm or a commercial enterprise. Properties financed through USDA loans should support safe, sanitary living conditions and be modest in size and design. All properties must adhere to local zoning and code requirements.

Special Situations and Assistance

In response to economic challenges such as inflation and market demand shifts, various programs have been put in place to support the agricultural community in Maryland. These initiatives are especially targeted toward farmers, ranchers, and distressed borrowers, offering financial relief and restructuring under the auspices of the Farm Service Agency and the Inflation Reduction Act.

Support for Farmers and Ranchers

Farmers and ranchers facing financial hardship due to fluctuations in demand or other economic pressures can find a supportive ally in the USDA's suite of assistance programs. Central to this support network is the provision of aid through funds allocated by the Inflation Reduction Act. This legislation includes measures aimed at relieving the fiscal strain on direct and guaranteed FSA loan borrowers.

Immediate USDA Assistance: Since October 2022, the USDA has distributed approximately $1.5 billion in aid to more than 24,000 farm loan borrowers.

Community Facilities Program: Aids in developing essential community facilities in rural areas for health, public safety, and public services to bolster local economies and improve quality of life.

Programs for Distressed Borrowers

The USDA has orchestrated programs specifically designed for borrowers of farm loans who are confronting the risk of delinquency or other financial difficulties. These programs are a testament to the USDA's commitment to sustaining the agricultural industry through challenging economic times.

Assistance Deadline: Borrowers in need must submit requests for support by December 31, 2023.

Available Aid: Programs offer restructured loan terms and additional financial support to prevent delinquency and support ongoing farm operations.

USDA service centers in Maryland are committed to facilitating these programs, providing guidance through resources like the website farmers.gov. This portal stands as a comprehensive source for borrowers to understand eligibility requirements and the breadth of assistance options, including the extraordinary measures taken to mitigate the impacts of economic stress on sectors like agriculture and related markets.

Regional Information and Contacts

The United States Department of Agriculture (USDA) provides services crucial to those seeking rural development loans and resources in Maryland. Information and assistance can be found through various service centers across the state, offering personalized help regarding USDA programs.

Maryland USDA Service Centers

USDA Service Centers in Maryland are integral points of contact for individuals seeking information and assistance with USDA loans.

Columbia USDA Service Center:

Address: [Local Address, Columbia, MD]

Phone: [Local Number]

Hours: Weekdays, 8 a.m. - 4:30 p.m.

Annapolis USDA Service Center:

Address: [Local Address, Annapolis, MD]

Phone: [Local Number]

Hours: Weekdays, 8 a.m. - 4:30 p.m.

Note: For more detailed information on each service center and additional locations, individuals should visit the USDA's official website or contact the state director's office.

Resource Access in Local Communities

Local communities in Maryland, including both rural and suburban areas, have access to numerous USDA resources.

Loan Servicing Issues: Residents can reach out to the Maryland State Office for queries regarding loan servicing.

Toll-Free Number: 1-800-721-0970

Office Hours: 8 a.m. - 4:30 p.m. Mon-Fri

Rural Development Resources:

Delaware and Maryland Rural Development Office

Contact for General Queries: 1-800-292-8293

Remote Status Information: Assistance is extended remotely, with in-person appointments available as authorized.

Compensating Factors Consideration:

Inquiries about compensating factors for loan qualification can be discussed directly with loan officers at the respective USDA Service Centers.

Residents of Columbia, Annapolis, and the broader state of Maryland are highly encouraged to utilize their local USDA Service Centers to obtain accurate information, as well as to navigate the specifics of applying for and managing USDA loans.