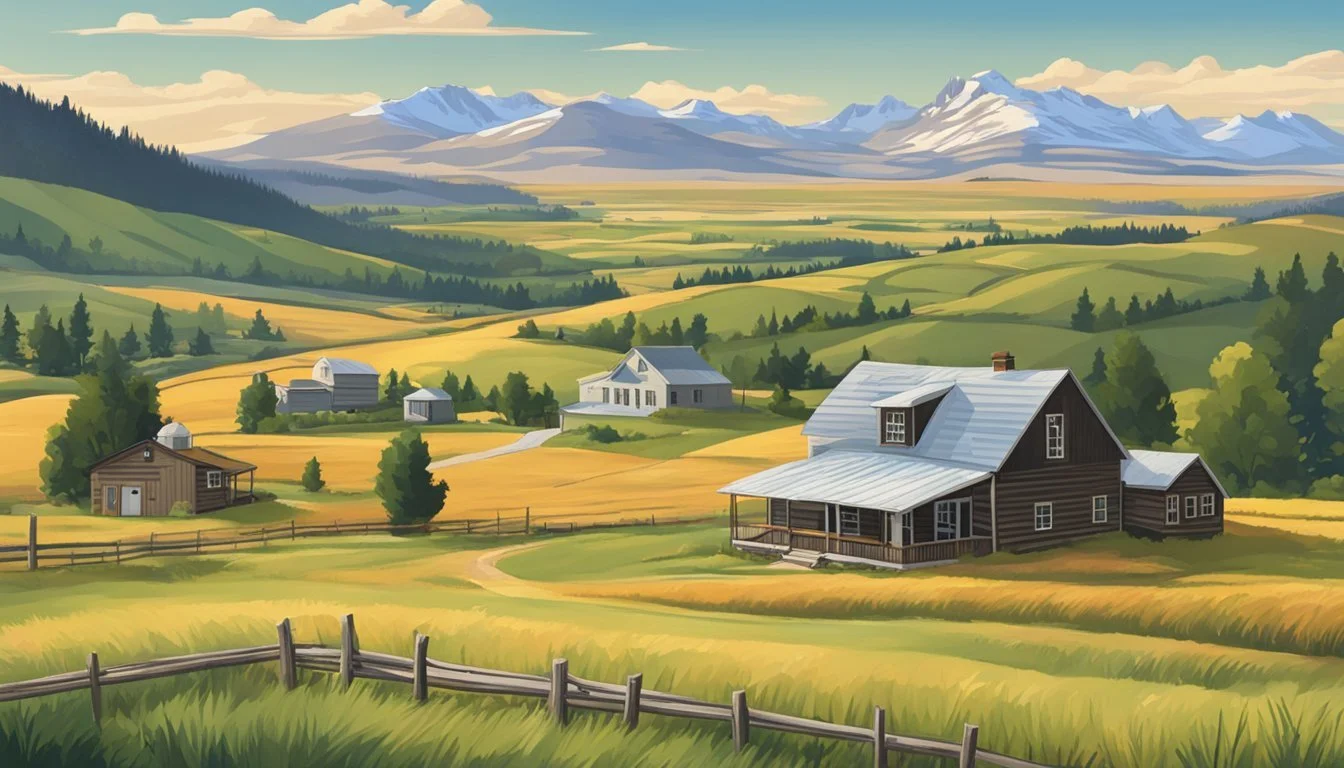

USDA Loans Montana

Your Guide to Rural Home Financing in the Treasure State

USDA loans in Montana offer a path for residents to achieve homeownership in rural areas of the state. These loans are backed by the United States Department of Agriculture and are designed to support the growth and stability of rural communities. They offer numerous benefits, including no down payment, lower interest rates, and government insurance. The USDA Farm Service Agency plays a significant role in assisting farmers and ranchers in Montana, ensuring they can maximize benefits from a variety of programs, including loans, price support, and disaster relief.

In Montana, the Single Family Housing Direct Home Loans Program is specifically tailored to help low- and moderate-income individuals purchase homes in rural areas. The program is constantly open, providing state-specific information and resources to prospective homeowners. This initiative is critical in a state where the housing market can be particularly challenging for first-time buyers and where the average borrower is 37 years old. Moreover, Rural Housing Site Loans offer another avenue for purchasing and developing housing sites for low- and moderate-income families, emphasizing the self-help construction method.

For agricultural producers and rural small businesses in Montana, the USDA also invests to expand markets and increase the business potential within these communities. By providing financial resources and support, the USDA's programs are instrumental in bolstering Montana's rural economy and enhancing the quality of life for its residents.

Understanding USDA Loans

USDA loans, offered by the United States Department of Agriculture, provide unique benefits to eligible homebuyers in rural and suburban areas. These loans aim to help individuals or families who have very low to low income secure housing with more favorable terms.

Key Features

No down payment: Borrowers can finance up to 100% of the property value.

Guaranteed loans: USDA guarantees a portion of the loan, allowing lenders to offer more favorable terms.

Competitive interest rates: Often lower than conventional loans.

Eligibility Requirements

Income limits: Applicants must have an income at or below the specified limits for their area.

Primary residence: The home must be used as the primary residence.

Location: Must be located in an eligible rural area as defined by USDA.

Creditworthiness: Borrowers must meet certain credit requirements.

Loan Terms

Repayment ability: Applicants should demonstrate the ability to repay the loan.

Loan period: Can typically extend up to 33 years (or 38 for very low-income earners).

Additional Considerations

Hazard insurance is required to protect against potential damage to the home.

Program instructions are detailed in USDA regulations, which lenders must follow.

Eligible areas and further program details can be obtained through USDA's Office of Rural Development or their website. Lenders across Montana offer these loans with updated rates and terms for the current year.

Eligibility Criteria for USDA Loans in Montana

When individuals in Montana look into USDA loan options, they must meet specific income, property, and credit criteria to qualify. These requirements ensure that the loan funds are directed towards eligible rural housing development.

Income Limits and Requirements

To qualify for a USDA loan in Montana, applicants must have an income that does not exceed 115% of the median household income for the area. It is essential that they demonstrate a reliable income history, typically for at least 24 months. Additionally, the USDA considers the income of all adults in the household when determining eligibility.

Property Eligibility

Properties financed with USDA loan funds in Montana must be located in designated rural areas. These zones are determined by USDA's mapping tools and typically do not include urban or metropolitan regions. As the search results indicate, only a very small percentage of the state is deemed ineligible, thus most areas in Montana will likely qualify.

Credit Requirements

Creditworthiness is a pillar in securing USDA loans. Applicants need a minimum credit score that varies by lender, but typically they should have a score of 640 or higher for automatic processing. Those with scores below this threshold may still apply, but they will undergo a more rigorous underwriting process. It is critical for borrowers to keep a clean credit history with no foreclosures or bankruptcies within the last three years.

Advantages of USDA Loans

USDA loans offer significant financial benefits for homebuyers looking to settle in rural Montana. These loans are designed with favorable terms to promote homeownership in less densely populated areas.

No Down Payment Options

USDA loans stand out for their no down payment requirement, which makes homeownership accessible to many who otherwise may not afford a traditional mortgage's initial costs. This feature removes a significant financial barrier, allowing borrowers to allocate funds to other expenses associated with purchasing a home.

Favorable Interest Rates

Borrowers benefit from favorable interest rates with USDA loans, often lower than conventional mortgages. The government's backing reduces lender risk and, in turn, can lead to more competitive rates. Lower interest rates mean reduced monthly payments and long-term interest savings.

Lower Insurance Costs

USDA loans are accompanied by reduced insurance costs due to the government guarantee. A guarantee fee is required but can be rolled into the loan balance. Unlike conventional loans, which require private mortgage insurance (PMI) if the down payment is less than 20%, USDA loans have an annual insurance fee that is typically lower than PMI rates, resulting in a more affordable mortgage insurance option.

These advantages make USDA loans a compelling choice for individuals seeking to realize their dream of homeownership in the rural communities of Montana.

How to Apply for a USDA Loan in Montana

Applying for a USDA Loan in Montana involves a clear process, the gathering of necessary documentation, and working with approved lenders. Applicants should note deadlines and may contact the Montana State Office for program-specific guidance.

Application Process

To begin the application for a USDA loan, applicants should access the official USDA loan application portal or contact the Montana State Office for assistance. The initial steps include:

Assessing Eligibility: Applicants must ensure they meet the income and property eligibility requirements for Montana.

Pre-Application: Submit a pre-application to receive guidance on the loan process and to understand the available programs.

Formal Application Submission: Fill out the appropriate forms provided by the USDA or through an approved lender.

Application Review: After submission, the application will be reviewed for completeness and compliance.

Deadlines are crucial, and applicants should be aware of the specific cut-off dates for application submissions which typically fall at the end of each quarter.

Required Documentation

Applicants must compile and submit a variety of documents during the application process, including:

Proof of Identity: Valid government-issued identification is required.

Proof of Income: Recent tax returns, pay stubs, and other financial statements.

Employment Verification: Documents that confirm current employment status.

Credit Information: Credit reports and scores to assess creditworthiness.

Property Information: If applicable, details about the property being purchased or improved.

The Montana State Office can provide a detailed list of necessary documents.

Finding USDA-Approved Lenders

Working with a USDA-approved lender is essential for securing a USDA loan for properties in Montana. Borrowers can:

Contact the Montana State Office: They can supply a current list of approved lenders.

Research Online: Use online resources to find lenders versed in USDA loan requirements.

Attend Workshops: Some applicants find value in attending lender workshops or USDA-sponsored events to find knowledgeable lenders.

By thoroughly preparing and working with the right lender, applicants increase their chances of a successful USDA loan application in Montana.

USDA Loan Programs in Montana

The USDA provides various loan programs in Montana to support homeownership and home repairs for low-to-moderate income individuals in rural areas. These programs offer unique benefits that often include lower interest rates and no down payment.

Single Family Housing Guaranteed Loan Program

This program aids prospective homeowners in obtaining affordable financing in rural areas, ensuring that they can find safe and sanitary housing. Lenders receive a guarantee from the USDA, which allows them to offer better terms to borrowers, often with no down payment required.

Single Family Housing Direct Home Loans

Known as the Section 502 Direct Loan Program, this offering assists low- and very-low-income applicants by providing payment assistance to enhance their repayment ability. This subsidy is critical for homeowners in maintaining long-term, stable housing.

Rural Repair and Rehabilitation Loans and Grants

Also referred to as the Section 504 Home Repair program, it provides loans and grants specifically for homeowners to improve, repair, or modernize their homes. For eligible elderly, very-low-income homeowners, this program focuses on removing health and safety hazards.

Rural Development and Community Support

The USDA's involvement in Montana focuses on enhancing the quality of life in rural areas through various loan and grant programs.

Business and Industry Loan Guarantees

The Business and Industry Loan Guarantee program bolsters the availability of private credit by guaranteeing loans for rural businesses. This initiative not only helps businesses to flourish and create jobs but also empowers the local economies by supporting a wide array of business activities for small enterprises.

Rural Energy for America Program

Rural Energy for America Program (REAP) offers financial assistance to rural small businesses and agricultural producers for purchasing and installing renewable energy systems or making energy efficiency improvements. These interventions help sustain rural communities by reducing energy costs and increasing the nation's energy independence.

Water and Waste Disposal Loan and Grant Program

The Water and Waste Disposal Loan and Grant Program is critical for rural communities, providing funds for clean and reliable drinking water systems, sanitary sewage disposal, sanitary solid waste disposal, and stormwater drainage to households and businesses in eligible rural areas. This program plays a crucial role in ensuring that the fundamental infrastructure for water and waste management is available, which is vital for public health, environmental protection, and community development.

Montana-Specific USDA Loan Information

Montana offers residents the opportunity to access USDA home loans, which are tailored to assist with purchases in rural areas. The state's economy, strongly tied to agriculture and natural resources, often makes these loans a fit for many local citizens seeking homeownership.

USDA Rural Development Offices in Montana

Montana is served by several USDA Rural Development offices located in key cities. They are the primary contact points for individuals looking to apply for USDA loans. These offices are situated in:

Billings

Bozeman

Great Falls

Helena

Kalispell

Missoula

Each office offers guidance on loan requirements, application processes, and other necessary details specific to the region's rural development.

Property Taxes and USDA Loans

In Montana, property taxes are determined by the local government, but they generally support natural resources and agricultural industry initiatives, which USDA loans promote.

Average Appraised Home Value: $119,022 (relevant for tax assessment)

Typical Tax Rates: Will vary based on locality and assessed home value

Applicants for USDA loans should consider these tax implications when determining their eligibility and calculating the overall costs of home ownership.

Local Resources and Support

Local resources are substantial in supporting prospective homeowners. Entities such as state departments of agriculture and industry organizations provide additional information and support which can complement the financial assistance received from USDA loans.

Key Industries: Natural Resources and Agriculture

Support Programs: Eligibility assistance, homeowner education, and financial planning assistance

Applicants are encouraged to tap into these resources for a well-rounded approach to homeownership in Montana’s diverse rural landscape.

COVID-19 and USDA Loans

The USDA loan program has incorporated measures to mitigate the financial impact of the COVID-19 pandemic on farmers and homeowners in Montana.

Impact of the Coronavirus Pandemic

The coronavirus pandemic introduced significant challenges for farmers in Montana. Many relied on USDA farm loans to manage their operations and found themselves facing financial hurdles due to disrupted markets and operational losses. To address these difficulties, the USDA implemented certain provisions that allowed borrowers to delay payments by moving scheduled payments to the end of the loan term.

CARES Act and USDA Loan Provisions

The CARES Act played a pivotal role in offering relief to those holding USDA loans. Under this federal relief effort, provisions included:

Automatic payments of $66 million from pandemic relief funds.

Loan assistance to up to 7,000 direct loan borrowers using FSA's disaster-set-aside (DSA) option.

Eligible farmers could have their next payment set aside, deferring the due date to the loan’s final maturity date or extending it up to 12 months for annual operating loans.

These measures were critical for the continuity and recovery of agricultural operations throughout Montana during the pandemic.