Tech Startups Reinventing Meat Production

Innovations Shaping the Future of Food

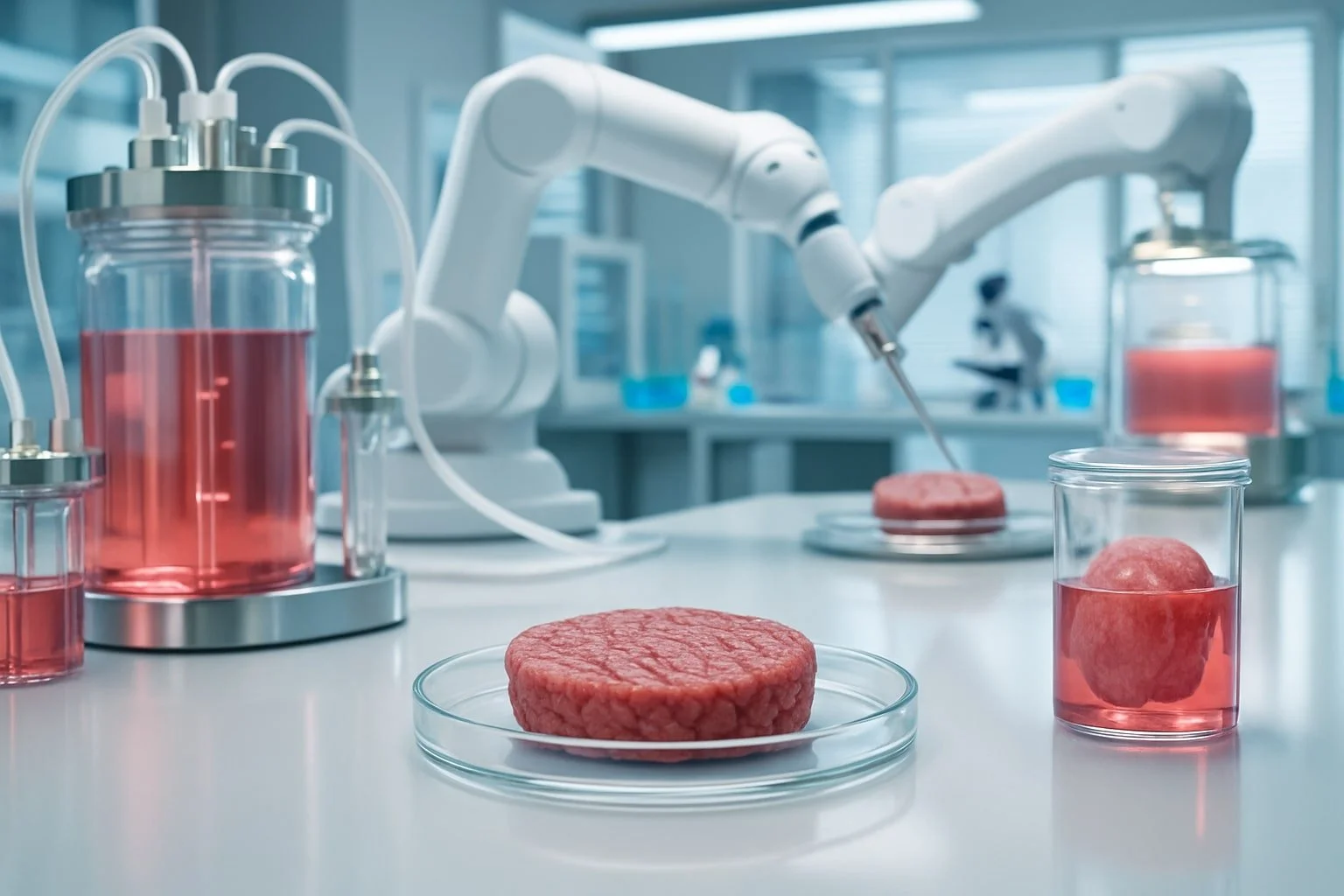

Tech startups are transforming meat production by developing innovative alternatives like cultured and cell-based meats, aiming to tackle sustainability, food security, and changing consumer demands. These young companies use biotechnology and cutting-edge food science to cultivate real meat directly from animal cells, reducing the need for traditional livestock farming.

Startups such as Clever Carnivore and Higher Steaks are developing products like cultivated pork sausage and other meat prototypes, showing tangible progress in this fast-evolving industry. Backed by millions in funding, these companies are not only changing what ends up on our plates but also influencing how the global food system can address urgent challenges.

With advancements in bioprinting, food structuring, and cell-based cultivation, the landscape of meat production is shifting. Readers interested in sustainable food and technology will find that these startups are leading the way toward a new era for the meat industry.

The Evolution of Meat Production

Meat production has developed from traditional animal agriculture into a field shaped by science and technology. New methods are being introduced that aim to address resource use, ethical concerns, and global food demands.

Traditional Livestock Farming

Historically, meat production has centered on raising livestock such as cattle, pigs, and chickens. This approach involves breeding, feeding, and managing animals from birth to slaughter. The process requires significant land, water, and feed, with some estimates indicating up to 70% of agricultural land is dedicated to livestock systems.

Environmental impacts remain a concern. Livestock farming is a notable source of greenhouse gas emissions and relies heavily on antibiotics and other inputs. Traditional practices also face challenges with animal welfare standards and disease management.

Conventional meat industry supply chains are complex. Slaughterhouses, transport networks, and labor-intensive processing facilities are integral, but often struggle with labor shortages and hygiene concerns.

Rise of Food Technology in Meat

Recent years have seen the emergence of food technology aimed at reinventing meat production. Companies now use tissue engineering to cultivate meat from animal cells, bypassing the need for large-scale animal farming.

Lab-grown or cultivated meat seeks to reduce land and water usage while minimizing emissions. Unlike conventional livestock farming, these processes are more controlled and can be tailored for food safety and nutritional consistency.

Automation and robotics are transforming processing facilities. Startups in the US and beyond are leveraging advances in biotechnology and automation to address labor shortages and improve efficiency. Novel ingredients, such as plant-based proteins and fermentation-derived products, are also gaining ground as meat alternatives.

These innovations promise greater transparency, traceability, and scalability in how meat is produced and delivered to consumers.

Types of Meat Innovation from Tech Startups

Tech startups are pushing the boundaries of how meat can be produced. Major advances are being made in cell cultivation, fermentation technology, and plant-based formulations, each offering new sources and textures for alternative proteins.

Cultivated and Cell-Based Meat

Cultivated meat—sometimes called cultured or cell-based meat—is grown from animal cells in controlled environments without the need to raise or slaughter animals. Startups develop processes to obtain a small sample of animal cells, which are then nourished in bioreactors using growth mediums rich in amino acids, sugars, and nutrients.

Key players like Clever Carnivore have focused on cultivated pork sausage, aiming for a taste and texture nearly identical to conventional meat. The scaling of cell-based meat depends on advancements in cell lines, bioprocessing, and achieving cost-effective production at larger volumes.

This method directly addresses animal welfare and aims to reduce the environmental impact of meat production, including lower greenhouse gas emissions and land use. Regulatory approval varies by country, but momentum is growing, with Singapore and the US providing early market access for select cultivated meat products.

Fermentation Technology

Fermentation technology harnesses microorganisms—such as bacteria, yeast, or fungi—to produce alternative proteins and meat-like products. Two main types are used: traditional fermentation (transforming plant ingredients with microbes) and precision fermentation (engineering microbes to produce specific proteins or fats).

Companies use fermentation to create ingredients like mycoprotein, found in some popular meat substitutes, or to synthesize animal-identical proteins without the animal. Precision fermentation allows startups to program yeast or bacteria to make casein or heme, which impart authentic texture and flavor to meat alternatives.

Fermentation offers scalability and efficiency advantages, as it can utilize agricultural byproducts as feedstock, reducing waste. It also typically requires less land and water compared to conventional livestock farming, making it attractive for sustainability-focused ventures.

Plant-Based Meat Alternatives

Plant-based meat alternatives rely on sources like soy, peas, mung beans, and wheat to replicate the appearance, texture, and flavor of animal products. Startups invest heavily in food science and extrusion technologies to create products such as burgers, sausages, and nuggets that closely mimic the eating experience of traditional meat.

Common ingredients include soy protein isolate, pea protein, coconut oil, and beet juice, with formulas refined to optimize taste, juiciness, and nutritional value. Advances in flavor chemistry and texturization have helped close the gap between plant-based proteins and animal meat.

Many plant-based products are now rich in protein, iron, and fiber, appealing to consumers seeking vegetarian or flexitarian diets. These alternatives offer rapid scalability and faster regulatory pathways, as they do not contain animal cells or require cellular agriculture facilities.

Leading Tech Startups in Meat Reinvention

Tech startups are redefining meat production through cell-cultivation, fermentation, and alternatives to seafood. These companies use biotechnology, scaling techniques, and product innovation to address consumer demand and reduce environmental impact in food systems.

Key Cell-Based Meat Startups

Cell-based meat startups are leading a significant shift in protein production. Mosa Meat is recognized for its cultivated beef developed in the Netherlands, focusing on bringing slaughter-free burgers to the market. Aleph Farms pioneers cultivated steak in Israel, using a unique platform to create whole-muscle cuts directly from animal cells.

Eat Just's GOOD Meat division, based in the US, has achieved regulatory milestones for its cultivated chicken in several countries. Upside Foods (formerly Memphis Meats) is another US-based leader, producing a range of cell-cultured meat products including chicken and beef.

Table: Select Cell-Based Meat Startups

Startup Flagship Product Country Mosa Meat Cultivated Beef Burger Netherlands Aleph Farms Cultivated Steak Israel Eat Just (GOOD Meat) Cultivated Chicken USA Upside Foods Cultivated Chicken, Beef USA

Innovators such as Clever Carnivore, which raised significant funding to develop cultivated pork sausage, are advancing the variety available to consumers.

Pioneers in Fermentation-Based Meat

Fermentation startups harness microbes and fungi to create meat alternatives with familiar textures and flavors. The Better Meat Co. specializes in mycoprotein, using fermentation to produce ingredients for hybrid and plant-based meat.

Quorn is a well-established brand in this category, utilizing fermented mycoprotein since the 1980s in the UK. Newer entrants such as Peace of Meat focus on cultivating fat and tissue through precision fermentation, enhancing the authenticity of plant-based or hybrid meats.

NATURE’S Fynd and other food tech startups use fermentation to produce proteins with less reliance on traditional agriculture. These methods offer resource efficiency and rapid scaling compared to cell-based approaches.

Lists of leading companies:

The Better Meat Co.

Quorn

Peace of Meat

Nature’s Fynd

Startups Transforming Seafood

Seafood alternatives are growing as overfishing and supply issues challenge the global market. Shiok Meats in Singapore leads with its cell-based shrimp, crab, and lobster, aiming to provide sustainable crustacean options for Asia and beyond.

BluNalu in the US develops cultivated fish fillets and aims to deliver the same taste and nutrition as conventional seafood. Finless Foods, also based in the US, focuses on bluefin tuna alternatives using cellular agriculture.

Table: Seafood Alternative Startups

Startup Focus Product Region Shiok Meats Cultivated Shrimp, Crab, Lobster Singapore BluNalu Cultivated Fish Fillets USA Finless Foods Cultivated Bluefin Tuna USA

These startups target not only environmental sustainability but also safety and traceability in the seafood supply chain. Their efforts contribute to expanding protein options for consumers concerned about the oceans.

Technological Breakthroughs Shaping the Industry

Key technological breakthroughs are allowing startups to address major scientific and commercial barriers in modern meat production. Advances in growth environments, muscle structure formation, and scalable processes are driving consistent progress in cellular agriculture and lab-grown meat.

Role of Growth Media and Bioreactors

Growth media is the nutrient solution that enables animal cells to multiply and develop outside of a living organism. Startups are focused on developing animal-free, cost-effective media that supply cells with amino acids, vitamins, and growth factors. Moving away from traditional serum-based media makes lab-grown meat more ethical and scalable.

Bioreactors provide the controlled environment needed for cell culture. Modern bioreactors regulate conditions such as temperature, pH, and oxygen to optimize cell health and proliferation. Startups are engineering bioreactors for both small-scale R&D and industrial-scale production, integrating real-time sensors and automation to improve efficiency.

Muscle Fibers and Bioprinting

Producing authentic meat texture hinges on the formation of muscle fibers. Companies use scaffolding materials to guide cells as they grow into aligned fibers, mimicking the texture and structure of conventional meat. Muscle fiber alignment directly impacts qualities like mouthfeel and appearance.

Bioprinting enables precise placement of multiple cell types—muscle, fat, and connective tissue—in defined patterns. Using digital templates, 3D bioprinting technology creates complex tissue structures, bringing lab-grown products closer to the sensory experience of traditional meat. Ongoing improvements in bioprinting speed and resolution are critical for achieving commercial viability.

Scalable Methods in Meat Production

To reduce costs and increase output, startups are adopting scalable methods throughout the production process. Continuous perfusion systems maintain high cell densities by constantly refreshing nutrients and removing waste, which allows for larger batch sizes.

Process automation is becoming standard, from media preparation to product harvesting. Modular production lines enable flexible scaling as market demand grows. Table 1 gives a quick overview of scalable strategies in cellular agriculture:

Method Purpose Continuous Perfusion Systems Maintain cell health, increase yield Automated Process Controls Reduce labor, increase consistency Modular Bioreactor Setups Flexible scaling, lower costs

Successful scaling is key to making lab-grown meat accessible and affordable for consumers and for advancing the food tech industry.

Nutritional Value and Consumer Benefits

Novel meat production techniques bring measurable changes to the nutritional profile of products, while also replicating familiar sensory properties. Consumers are increasingly considering both health and experience when choosing between traditional and new meat options.

Nutrition Profiles and Health Aspects

Tech startups in cultured and plant-based meat are addressing key nutrition concerns. Many products are designed to have lower saturated fat and reduced cholesterol compared to conventional meats. Startups frequently use sustainable protein sources such as soy, peas, or cultured animal cells, optimizing amino acid content and bioavailability.

Several cell-based meats now offer iron, vitamin B12, and other micronutrients at levels similar to beef or poultry. Companies also actively reduce or eliminate antibiotics and hormones, increasing consumer confidence in the health profile of these foods.

Some brands fortify their products with fiber, omega-3 fatty acids, and other nutrients not found in traditional meat, supporting heart health and digestive function. The flexibility in formulation allows for tailored products that help meet specific dietary needs.

Taste, Texture, and Culinary Applications

Advancements in food technology have narrowed the sensory gap between traditional and alternative meats. The latest cell-based and plant-based burgers and steaks are engineered to provide a meat-like bite and juiciness.

Startups use plant proteins, fats, and heme analogs to replicate the taste of beef or chicken. Some lab-grown options include actual animal fat cells for enhanced succulence and flavor. Chefs and food producers note that these products can be cooked, seasoned, and served in a variety of dishes—from grilling to stir-frying—without significant adjustments.

Consumers benefit from a familiar culinary experience, but with the added value of consistent quality and the possibility of reducing the risk of food contamination. The ability to control both flavor and nutrition during production presents opportunities for both food service and home cooking sectors.

Sustainability and Environmental Impact

Tech startups are transforming meat production with a focus on minimizing environmental harm. Their methods aim to cut emissions, conserve resources, and address the challenges posed by traditional animal agriculture.

Greenhouse Gas Emissions Reduction

Conventional meat production is a major source of greenhouse gases like methane and nitrous oxide. Innovative startups are addressing this impact through cell-based and plant-based meat technologies.

Cultivated meat, produced from animal cells without raising or slaughtering livestock, produces significantly fewer emissions. For example, a 2023 industry analysis suggests cultivated meat can generate up to 92% less greenhouse gas emissions compared to beef from cattle.

Plant-based meat alternatives also help lower emissions by requiring less energy and eliminating enteric fermentation—a primary source of methane. Many startups now use renewable energy for their operations, further reducing total emissions and supporting a more sustainable food system.

Deforestation and Land Use

Traditional livestock farming is a leading driver of deforestation and land degradation, especially in regions like the Amazon. Tech startups reduce these pressures by developing production methods that require far less land.

Key Comparisons:

Production Type Land Needed per 1kg Meat Alternative Conventional Beef ~25 m² Cultivated Meat <2 m² Plant-Based Meat <1 m²

Switching to cell-based or plant-based meats drastically decreases the need for pasture and feed crops. This shift helps preserve forests, protect biodiversity, and allows for more efficient land usage. These innovations can also restore land previously used for intensive animal agriculture.

Water Usage and Pollution

Raising livestock demands vast amounts of water and contributes notably to water pollution through runoff and waste. Tech startups offer solutions with much lower water footprints and more controlled production processes.

Plant-based and cultivated meat require up to 90% less water per kilogram of product compared to traditional beef. In controlled facilities, waste can be monitored and treated, sharply reducing pollution risk from manure and fertilizer runoff.

Many startups are adopting closed-loop water systems and optimizing resource efficiency. These approaches help maintain water quality and significantly reduce the environmental impact associated with conventional meat production.

Animal Welfare and Ethical Considerations

Tech startups entering the meat production sector are prioritizing innovations aimed at reducing animal suffering. They focus on new production systems that address animal welfare challenges and respond to evolving consumer expectations.

Impact on Animal Cruelty

Lab-grown and plant-based meat alternatives virtually eliminate the need for traditional livestock farming, which typically involves practices that can cause stress, injury, or poor living conditions for animals. By reducing or fully removing live animals from the supply chain, these startups have a direct effect on lowering rates of animal cruelty.

Traditional meat production systems often rely on industrial-scale processes, where standardized environments and high output targets contribute to compromised animal welfare. In contrast, ethical frameworks adopted by emerging companies emphasize transparency, humane treatment, and the minimization of animal involvement.

Many startups are also committed to independent animal welfare audits and third-party certifications. This ensures adherence to best practices while providing consumers with clarity on how animals are treated throughout the process.

Societal Perceptions of Cruelty-Free Meat

The shift toward cruelty-free meat is reshaping consumer attitudes and purchasing habits. Cultured and plant-based meats are widely viewed as more ethical, especially among consumers concerned about animal suffering.

Social acceptance of these products is growing, driven by increased awareness of the negative impacts of industrial livestock farming. Tech companies actively promote the absence of animal slaughter as a key selling point, which resonates with both vegetarians and omnivores seeking more humane options.

Surveys indicate that labeling meat alternatives as cruelty-free increases the likelihood of consumers trying these products. Transparent marketing and clear ethical messaging play a significant role in building trust and encouraging acceptance of new, animal-free protein sources.

Global Food Security and Supply Chains

Advances in food technology startups are directly impacting both food supply stability and modern supply chain practices. These developments are critical for addressing ongoing challenges in food security and distribution efficiency worldwide.

Improving Food Supply Stability

Startups focusing on cultivated meat and plant-based proteins have provided new ways to diversify the food supply. By producing meat directly from animal cells or plant sources, companies are less dependent on traditional agriculture and livestock farming. This reduces vulnerability to diseases, weather fluctuations, and disruptions caused by global events.

Key benefits include:

Lower risk of supply chain breakdowns

Potential for scalable production in urban areas

Reduced reliance on land and water resources

These innovations allow for localized manufacturing, which means food can be produced closer to where it will be consumed. Companies like Higher Steaks, for example, use bioreactor technology to cultivate pork in the UK. This limits waste and decreases dependency on long, complex supply chains.

Innovative Approaches to Distribution

FoodTech startups are also redesigning the distribution process by using technology such as blockchain, IoT sensors, and AI-driven logistics. These tools make it possible to track food from lab production to final destination with improved transparency.

Examples of new distribution models:

Direct-to-consumer platforms for home delivery of alternative proteins

Automated cold chain systems to maintain product quality

Digital platforms matching local supply and demand

By digitizing supply chains, these companies can quickly respond to shifts in consumer demand, reduce spoilage, and lower carbon footprints. This not only supports food security but also creates more resilient supply systems ready to adapt to new challenges.

Regulatory and Market Approval Landscape

Cultivated and cell-based meat startups face complex requirements before entering markets. Key regulatory agencies, cost hurdles, and country-specific frameworks shape how quickly these products reach consumers.

Role of the U.S. Department of Agriculture

The U.S. Department of Agriculture (USDA) works alongside the Food and Drug Administration (FDA) to regulate cultivated meat production. The FDA assesses food safety and cell line development, while the USDA oversees processing, labeling, and inspections.

Companies must submit data on cell sourcing and manufacturing to obtain approval. Labeling requirements remain strict to avoid consumer confusion. Startups follow a clear, structured review process, but must adapt to evolving guidance as the agency’s standards develop.

In 2023, the USDA granted its first regulatory approvals to U.S. firms, opening the path for limited commercial sales. However, the approval process remains time-consuming and resource-intensive, especially for smaller startups with limited regulatory expertise.

Challenges to Regulatory Approval

Achieving regulatory approval involves high research and development (R&D) costs, large-scale production validation, and complex food safety documentation. Startups often face delays due to the need for robust data on safety, quality, and consistency.

Even with initial approvals, scaling production from pilot projects to commercial levels is difficult. Regulatory bodies require extensive verification of every production step. Investor confidence can fluctuate as approval timelines stretch, adding financial strain.

Large agricultural interests may lobby to influence regulatory conditions. These external pressures can add uncertainty, especially for smaller companies attempting to compete with established players.

International Regulations and Standards

Outside the U.S., regulatory approaches vary widely between regions. Australia and New Zealand have moved forward, recently granting regulatory approvals to companies like Vow, which completed one of the largest production runs for cultured meat.

In China, interest in cell-based meat has grown as leaders explore novel food technologies for food security. Regulatory frameworks remain under development, with some officials emphasizing the urgency of creating new standards for market entry.

The European Union enforces stringent food safety review processes, often resulting in longer approval timelines. Individual countries such as Singapore have already allowed limited commercial sales, setting early precedents for others to follow.

The Future of Meat Production and Consumer Adoption

Startups are using cell-based and plant-based technologies to reshape the meat industry. Shifting consumer preferences and ongoing innovations are driving these changes toward more sustainable and accessible options.

Trends in Consumer Acceptance

Consumer attitudes toward alternative meat products have evolved rapidly. Products that mimic conventional meat, such as those from Beyond Meat and other startups, are no longer marketed only to vegans and vegetarians. They are now designed for a broader range of consumers, including those who typically eat animal-derived meat.

Taste, texture, and familiarity play significant roles in willingness to try and adopt new proteins. Recent advancements have led to alternatives like cultivated pork sausage and "bloody" plant-based burgers that come closer to the eating experience of traditional meat.

Increased public awareness about environmental, ethical, and health concerns is also influencing purchasing decisions. However, acceptance can be limited by higher price points and skepticism about new food technologies, especially cultured or lab-grown meat.

Potential for Mainstream Integration

Lab-grown and plant-based meat startups are aiming for large-scale, mainstream market presence. Analysts predict that cultivated meat may reach up to 10% of the global meat market by 2030, supported by regulatory progress and consumer demand.

Keys to mainstream integration include improving affordability, expanding product variety, and building consumer trust in production methods. Companies are actively working on scaling up manufacturing and reducing cost barriers.

Major players like Beyond Meat have already entered traditional retail and food service channels. These developments point to a gradual blending of traditional and alternative meat options on store shelves and menus—expanding choice rather than forcing a shift. The coming years will likely bring more product launches, greater availability, and wider normalization of meat alternatives.